In a year filled with important financial decisions, the upcoming expiration of more than $3.4 trillion in individual income and estate tax cuts is set to take center stage. This issue, largely debated between Republicans and Democrats, will have a significant impact on the country’s deficit. The Congressional Budget Office estimates that with corporate tax changes and interest factored in, the deficit could swell to $4.6 trillion.

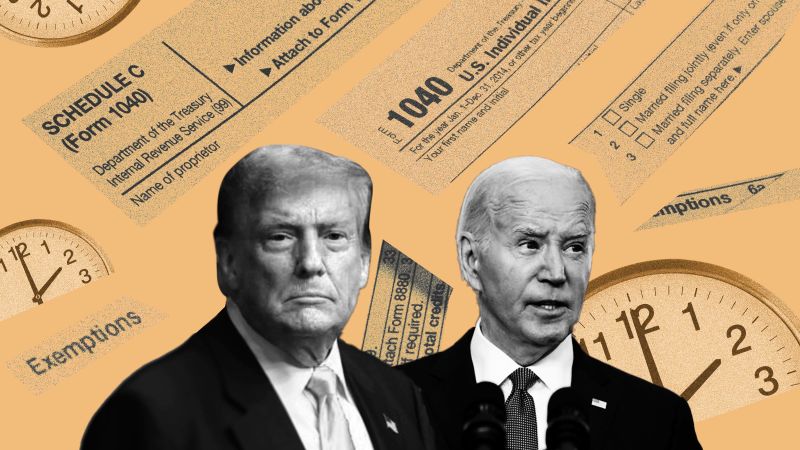

The outcome of the 2024 presidential election will be crucial, as President Joe Biden and former President Donald Trump have already outlined their positions on how they would handle the expiring provisions of the 2017 Tax Cuts and Jobs Act. President Biden has expressed his intention to let the income tax cuts for the wealthy expire while protecting those earning less than $400,000 annually from tax hikes. He has also proposed raising the corporate tax rate to 28% to help cover the costs of extending tax cuts for most Americans.

On the other hand, former President Trump has promised significant tax cuts for all income levels and businesses. He has pledged to extend the law’s tax cuts, which he believes would benefit the middle class and stimulate economic growth. The upcoming discussions are expected to be contentious, as lawmakers consider the fate of a number of costly tax provisions that will impact both taxpayers and the federal budget.

Congress will have to grapple with whether to extend these provisions and how to pay for them. The possibility of a temporary extension, as was done in 2010, remains on the table if lawmakers are unable to reach a resolution. It is clear that the upcoming debate on the expiring tax cuts will be complex and have far-reaching implications for the nation’s fiscal health.

As the country faces mounting concerns over the deficit and debt levels, the decision on how to handle the expiring tax provisions will be closely watched. Federal Reserve Chair Jerome Powell has already warned of the nation’s unsustainable fiscal path, adding further urgency to the upcoming discussions in Congress. The outcome will not only impact the country’s finances but also shape the economic landscape for years to come.