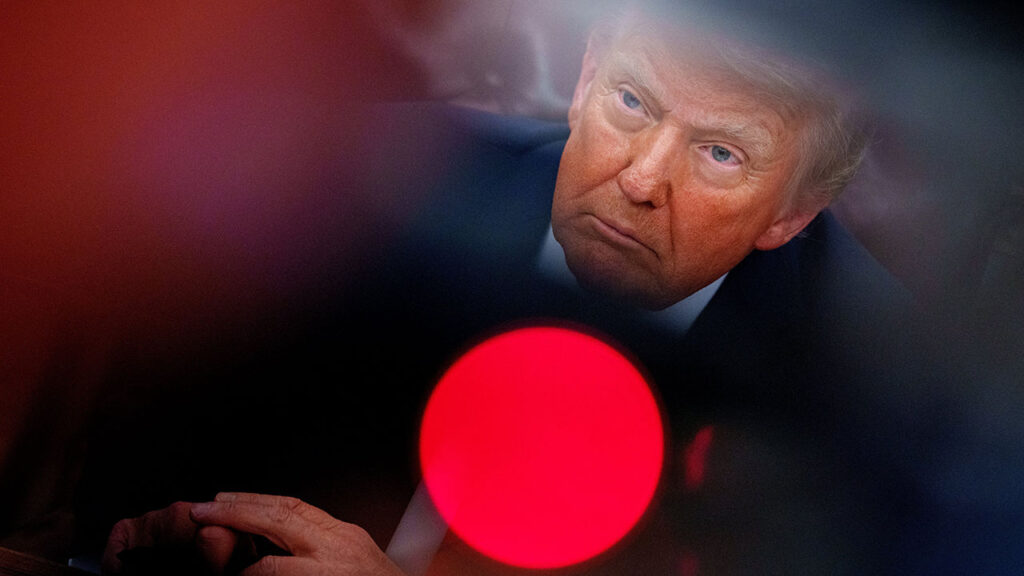

One of the predominant concerns regarding President Donald Trump’s economic strategy centered around his potential to compromise the Federal Reserve’s autonomy. There were widespread apprehensions that he might exert pressure on the central bank to lower interest rates significantly, thereby undermining its independent policymaking role. However, as of now, those fears appear to have been unfounded. The Fed has maintained its distance from political influence, continuing to operate as a separate entity that guides monetary policy according to prevailing economic conditions rather than external pressures.

Instead of challenging the Federal Reserve directly, President Trump has pursued a more complex dilemma: convincing investors that the rates determined by market forces should be reduced. This objective specifically targets the yields on ten-year Treasury bonds, an essential benchmark for various financing costs in the economy. On February 25th, 2023, these yields experienced a notable decline, reaching their lowest point since mid-December of the previous year. The administration’s strategy appears to be that lower yields would stimulate borrowing and investment, thus fostering economic growth.

However, interpreting this development as a straightforward success would be misleading. The drop in Treasury yields can be attributed to several factors, including market sentiments influenced by global economic conditions, inflation expectations, and shifts in investor behavior rather than solely an outcome of Trump’s policies. Market fluctuations are inherently complex, dictated by a myriad of elements that include geopolitical events, domestic economic indicators, and fiscal policy debates. Hence, while the administration may have set ambitious goals for interest rates, achieving them relies heavily on market dynamics that often extend beyond political reach.

Additionally, Trump’s rhetoric around the economy and interest rates plays a crucial role. His administration has often communicated a vision of economic prosperity characterized by lower borrowing costs, which he believes are essential for fostering business investment and stimulating growth. However, the effectiveness of this narrative is subject to skepticism among financial analysts and economists, who caution that overriding market forces without due consideration could yield unintended consequences. For instance, a prolonged era of low-interest rates may fuel asset bubbles or encourage excessive risk-taking among investors, potentially destabilizing the economy in the long term.

Moreover, the complexities of global finance must be acknowledged in this context. U.S. Treasury yields are closely linked with international markets, where yields in other developed economies can influence investor behavior domestically. As such, a downward trend in U.S. rates does not exist in a vacuum; rather, it interacts with the broader financial landscape. For instance, if yields in other nations rise or if geopolitical instability emerges, investors’ preferences might shift, impacting U.S. Treasury yields in ways that are unpredictable and challenging to manage.

As the scenario unfolds, the administration’s economic team faces a difficult balancing act. They must navigate the intricate web of domestic and global economic indicators, manage expectations, and articulate a persuasive economic vision to the markets. The ultimate goal remains clear: to lower borrowing costs, incentivize investment, and stimulate economic activity. However, the path to achieving this goal is fraught with challenges, especially given the powerful forces that shape interest rates and market sentiment.

In conclusion, while President Trump’s approach has not involved an overt confrontation with the Federal Reserve regarding its independence, the pursuit of lower market-determined rates has posed a significant challenge. The landscape of interest rates, influenced by various economic factors, remains a key battleground for this administration’s economic agenda. As it moves forward, the intersection of policy intentions and market realities will continue to determine the efficacy of its strategies. The pursuit of sustainable economic growth demands a nuanced understanding of both domestic and global economic variables, making this a continually evolving discourse.