The escalating trade tensions between China and the United States, which represent two of the largest economies in the world, have increasingly entangled them in a complex web of tariffs and restrictions. The situation has further worsened recently, demonstrating minimal indications of reconciliation. A significant event occurred this past week, when both nations resorted to imposing substantial tariffs on each other’s goods, a step familiar to observers of their trade relationship characterized by intense competition and conflicting interests.

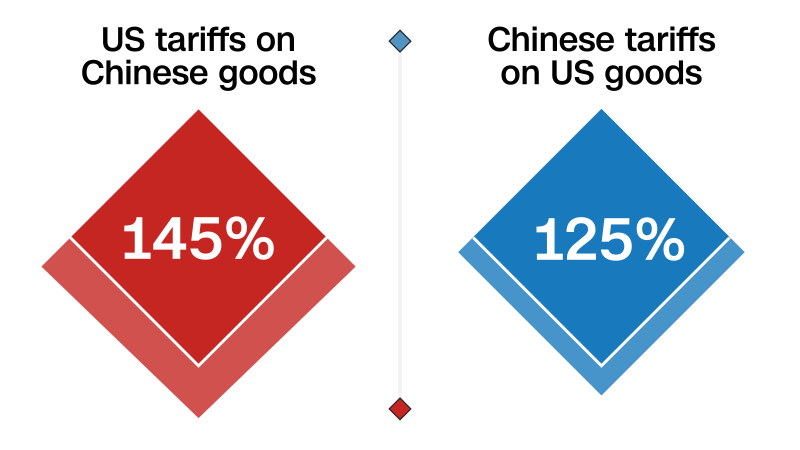

Recently, the Chinese government announced an eye-watering increase in tariffs on imports from the United States, raising them to 125%. This decision was made mere hours after a statement from the Biden administration indicated an evaluation of the existing tariff structure, proposing that Chinese goods imported into the United States now incur an impressive tariff rate of at least 145%. This rapid escalation has left economists, analysts, and global observers in a state of uncertainty, prompting many to speculate on the potential consequences and durations of such an aggressive trade approach. The currency markets, consumer sentiment, and international supply chains are all susceptible to the repercussions of these imposing tariffs.

But how did this situation culminate to its current state? The timeline of exchanges of tariffs akin to tit-for-tat reflects long-standing grievances and underlying economic hostilities between the two nations. The history of these trade relationships reveals an intricate backdrop filled with accusations of unfair trade practices and intellectual property theft. Over recent years, the United States has repeatedly criticized China for manipulating its currency and subsidizing domestic industries at the expense of foreign competitors. Consequently, the U.S. initiated various trade policies aimed at protecting American interests and leveling the playing field for its domestic industries.

China, on its part, has consistently retaliated against U.S. initiatives, leading to a further deterioration of relations. The economic sanctions imposed by both parties have had ripple effects, not only impacting their national economies but also creating uncertainty in the global market. Stakeholders, from multinational corporations to small businesses, are increasingly concerned about the potential for reduced trade volumes and disruptions in supply chains essential for their operations. As both nations firmly hold their ground, the question remains—where will this enhance tension ultimately lead?

It is vital to keep a close watch on future developments in this ongoing saga. The growing strains in the economic relationship between the U.S. and China may not only affect bilateral trade but also have significant implications for international economic policies. Markets around the globe are typically sensitive to such geopolitical events, and reactions often lead to fluctuations in investment and trade decisions. Those who closely monitor the financial landscape recognize that when the world’s leading economies engage in protectionist measures such as these, the ramifications can arise in unexpected manners.

In summary, the current trade war represents a continuation of a fraught relationship marked by deep-seated distrust and competing economic agendas. The decision to escalate tariffs reflects a struggle for dominance that reaches far beyond mere economic figures—it taps into national pride, technological supremacy, and geopolitical positioning. Sources of tension are deeply entrenched; thus, resolving these issues will require extensive negotiations, commitments to change, and perhaps a realization from both parties that cooperation may yield better long-term benefits than conflict. Getting a clearer picture of where events might lead demands an understanding of both historical context and current dynamics, a reflection that remains essential as nations strive to navigate this uncertain economic landscape.