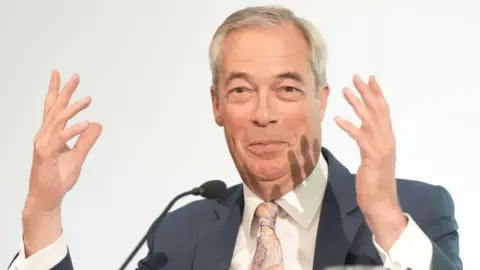

In a recent political proposal, Nigel Farage, leader of Reform UK, has suggested a controversial plan where non-domiciles (non-doms) living in the UK could pay a fee of £250,000 to exempt themselves from various UK taxes. This initiative, according to Reform UK, aims to generate revenue to support individuals in lower income brackets. By doing so, they hope to attract wealthy individuals and entrepreneurs back to the UK, which could potentially lead to increased investments and job creation.

Non-domiciles are individuals who reside in the UK but maintain a permanent home elsewhere for tax purposes. Historically, these individuals have benefitted from significant tax advantages, only being liable for taxes on UK income while their overseas income remains untaxed. Under the Reform UK proposal, non-doms would be required to pay a substantial lump sum in exchange for a special Britannia Card. This card would grant them exemption from taxation on their foreign earnings, profits made abroad, and even inheritance tax, which has become a focal point of criticism against the plan.

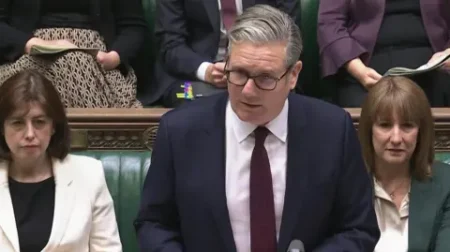

Labour’s current Chancellor, Rachel Reeves, has been quick to critique this proposal, asserting that it would essentially furnish a “tax cut for foreign billionaires.” She emphasized that such a scheme would have tangible implications for the public finances, potentially leading to higher taxes or cuts in essential public services, including the National Health Service (NHS), as the government would be deprived of vital revenue. Her strong stance reflects broader concerns about the fairness and viability of such a tax policy, particularly in times of economic uncertainty.

Speaking at a press event in central London, Farage argued that the initiative could attract “tens of thousands” of individuals to the UK, helping to reverse what he perceives as an alarming trend of skilled professionals leaving the country. He identifies these individuals as crucial to the economy—entrepreneurs, risk-takers, and job creators who could significantly contribute to the UK tax base once they settle in the country. Farage contended that the initial £250,000 fee is merely a fraction of the overall economic contribution these new residents would generate through expenditure in various taxes, including property and value-added taxes (VAT).

However, skeptics of Farage’s plan question the potential ramifications of inflating property prices, particularly in high-demand areas like London, which could make housing unaffordable for locals. While Farage acknowledged this concern as a valid point, he argued that it would not significantly affect affordable housing options. Reform UK projects that the revenue generated from this policy could amount to between £1.5 billion and £2.5 billion annually, ensuring that the poorest 10% of full-time workers receive a direct financial benefit from these proceeds.

This latest proposal emerges against the backdrop of Labour’s own attempts to reform the rules surrounding non-dom status. Earlier, the Labour government announced plans to abolish the non-dom status, which has long been perceived as an avenue for wealthy individuals to avoid substantial tax obligations by designating other countries as their permanent homes. Recent government changes, including the introduction of transitional phases to ease the impact on these individuals, indicate ongoing negotiations between maintaining revenue and keeping affluent residents in the country.

The debate surrounding Farage’s proposition has unveiled various facets of economic policy. Critics have labeled his plan as “fantasy economics,” arguing that it would inadequately address the national budgetary needs and would disproportionately favor the wealthy. In contrast, Conservative shadow chancellor Mel Stride highlighted that serious strategies are needed to effectively increase disposable income for the public rather than what he termed as eyebrow-raising policies lacking logical underpinning.

In conclusion, Farage’s proposal represents a significant pivot in UK tax policy surrounding non-domiciles, stirring a contentious dialogue among political leaders regarding economic strategies that prioritize either attracting foreign wealth or ensuring equity in the fiscal responsibilities of high earners. Consequently, the unfolding scenario demands careful scrutiny as fiscal pressures and social equity clash in an ever-evolving economic landscape.