The legislation that President Donald Trump heralded as the “big, beautiful bill” has made waves across varying sectors of the American economy. The Senate successfully passed the bill, which is under review by the House of Representatives, and Trump believes it may become one of the most notable legislative achievements in U.S. history. However, as with most sweeping legislative measures, its effectiveness and beauty are subject to individual perspectives, leading to varying interpretations of its implications across diverse demographics, industries, and communities.

While some sectors see promise in the bill, others express concern. Corporate America, represented by large business groups such as the U.S. Chamber of Commerce and the Business Roundtable, has celebrated the Senate’s approval. These entities expect to benefit significantly from the bill’s move to solidify tax breaks originally outlined in the 2017 Tax Cuts and Jobs Act, thereby solidifying their financial standing.

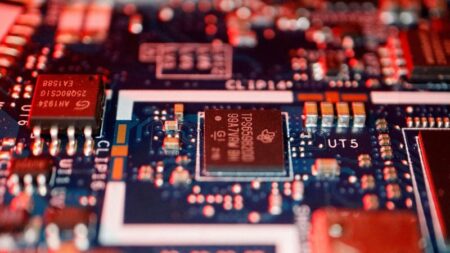

Manufacturers, in particular, have welcomed the significant reforms proposed in how the U.S. tax code manages the construction of new manufacturing facilities. Under the new legislation, companies can fully and immediately deduct the costs associated with constructing new manufacturing sites. This provision, which is retroactive to January 19, 2025, extends to projects initiated before January 1, 2029. Additionally, the bill is poised to incentivize domestic chip manufacturing by enhancing tax credits for semiconductor companies establishing production plants in the U.S.

Small businesses and partnerships, represented by the National Federation of Independent Business, have also expressed approval, especially for provisions implementing permanent deductions for certain pass-through entities. This specific deduction benefitting small business owners is proposed to be increased from 20% to 23% in the House version of the bill, while the Senate bill retains it at 20%.

On the other hand, high-income earners stand to gain a boost, with projections suggesting that the net income for the wealthiest 20% could increase by nearly $13,000 annually after accounting for taxes and transfers. For the top 0.1% of earners, the annual income increment could exceed $290,000. The revised limits on deductions for state and local taxes for high-income households may further enhance their financial position, though this measure does not extend to millionaires who lost their jobs, as they will not qualify for unemployment benefits under the bill.

Certain workers will also find relief, as specific tax breaks will remain effective until 2028. Employees in traditionally tipped occupations may be able to deduct up to $25,000 in tip income, while those receiving overtime pay can deduct an additional $12,500. However, highly compensated individuals with earnings exceeding $160,000 in 2025 will not qualify for these benefits.

Conversely, low-income Americans may face significant setbacks. The proposed legislation includes cuts to vital safety net programs such as Medicaid and food assistance (SNAP). For the first time in its history, Medicaid could mandate work requirements, particularly affecting parents of teenagers aged 14 and older. With the anticipated loss of benefits due to these new conditions, many low-income citizens may find themselves without a safety net, particularly since many would not have access to alternate job-based health insurance. Estimates suggest that the bill could lead to over 10 million individuals being uninsured by 2034.

Health care provisions have drawn criticism from hospitals, who express concern over proposed reductions in state support for caring for Medicaid enrollees. The American Hospital Association has suggested that the $1 trillion in Medicaid cuts could irreparably harm the healthcare system, thereby endangering access to care for vulnerable populations. Moreover, the Senate’s stringent verification requirements for obtaining federal premium subsidies under the Affordable Care Act could exacerbate these concerns, potentially leaving many middle-income families without insurance.

In terms of clean energy initiatives, there is significant disappointment with the legislation’s treatment of renewable energy projects. Despite the removal of a proposed excise tax on wind and solar, the legislation ultimately strips incentives for these projects by 2027 and imposes stringent qualification criteria. Electric vehicle manufacturers also stand to lose ground, as the bill ends existing EV tax credits, which were previously slated to continue until 2032.

Moreover, those wary of rising deficits are raising alarms about the projected increase of about $3.4 trillion over the next decade as a result of the bill. This rise in the deficit could lead to elevated interest rates, making borrowing for citizens and businesses more expensive. The Congressional Budget Office (CBO) projects that U.S. federal interest payments may exceed $1 trillion annually, a staggering amount that already surpasses the federal government’s entire defense budget.

In summary, the bill evokes diverse responses across various segments of society. While many sectors will benefit from tax cuts and other provisions, the balancing act of economic support and the potential detriment to low-income families may undermine its claims of being not only “big and beautiful” but also equitable. Balancing the financial health of various sectors and maintaining robust safety net programs for vulnerable populations presents a challenging