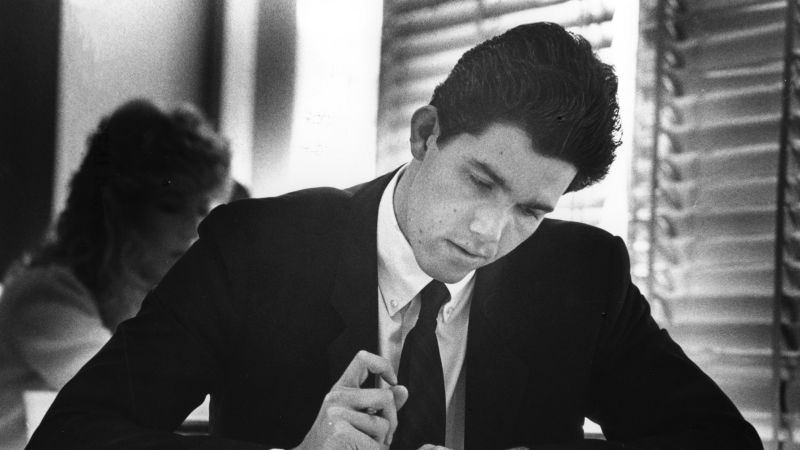

In the recently launched CNN Original Series “Billionaire Boys Club,” viewers are transported to the opulent yet treacherous world of 1980s Los Angeles, which pulsated with dreams of wealth but was riddled with deceit, fraud, and even murder. The series delves into the lives of a group of ambitious young men, led by Joe Hunt, who, filled with aspirations of making their fortune, embark on a new business venture that turns into a cautionary tale about the perils that accompany unchecked ambition and greed.

As a key figure in this narrative, Hunt reconnects with high school classmates Dean Karny and Ben Dosti, and together they establish a social and investment club. At the heart of their enterprise lies an insatiable quest for wealth and power. The tale unfolds to reveal how their innocent dreams quickly devolve into a sinister web of deception as greed propels them down a destructive path.

The series serves as a poignant reminder that such predatory schemes are not isolated events but part of a broader, recurring theme throughout modern financial history. Experts in economics and finance, such as Stanford’s Anat Admati, discuss the persistent nature of greed in markets and its capacity to exploit individual desires for wealth. Admati notes, “Greed is about wanting things to own, to consume. It’s pervasive.” This characteristic of human behavior is particularly pronounced in finance, where the promise of rapid wealth can manipulate emotions and lead individuals to invest in dubious schemes often characterized by high risk and low transparency.

Historical precedence is clear; the financial world has seen its fair share of corruption, from high-profile cases like the Enron scandal to the notable Ponzi scheme orchestrated by Bernie Madoff. Just recently, the U.S. Securities and Exchange Commission (SEC) charged a Georgia-based company for running a $140 million Ponzi operation. Academic voices like David Smith from Pepperdine University underscore that, regardless of the era or context, the motivations behind greed and the pursuit of wealth reverberate through every instance of financial fraud. Smith points out that financial incentives drive human behavior, and the longing for wealth can lead individuals down dangerous trajectories.

In the current landscape of finance, where cryptocurrencies have emerged, new avenues for fraud have materialized. Hilary Allen, a law professor, highlights how the allure of digital currencies—particularly those of little intrinsic value—can foster scams. The alarming statistic of over $5.6 billion in reported fraud related to cryptocurrency in 2023—a staggering 45% increase from 2022—serves as a stark reminder of the risks that abound in the modern financial jungle.

The themes of greed and deception are deeply intertwined, offering fertile ground for fraud. Allen emphasizes that while traditional financial markets have their flaws, the relative transparency they provide is often lacking in the realm of cryptocurrency, leading many to fall for scams. These challenges are compounded further by misleading promises and the hype surrounding potential windfalls.

Despite the elaborate tales of greed, fraud can manifest in everyday scenarios, from phishing schemes to dubious online offers. To safeguard themselves, experts strongly suggest vigilance in scrutinizing investment opportunities. Key advice includes assessing whether an opportunity seems “too good to be true,” a maxim that resonates in the world of finance.

Moreover, understanding the human inclination towards greed and fraud illuminates why stories like the “Billionaire Boys Club” captivate our interest. These narratives tap into fundamental human emotions surrounding ambition and the desire for quick financial gain. Individuals must adopt a calculated approach when venturing into investments, whether in stocks or cryptocurrencies, keeping in mind their risk tolerance. Consulting financial advisors and engaging in discussions with trusted friends and family can help mitigate the risks associated with poor financial decisions.

Ultimately, the cautionary narratives surrounding greed and fraud remain timeless. “Billionaire Boys Club” highlights not just the allure of wealth but also the dark implications of losing sight of ethical boundaries in its pursuit. As these lessons echo through history, they serve as vital reminders in our ongoing journey through the complex landscape of finance.