A TRILLION DOLLARS. That staggering figure is likely a source of sleepless nights for Scott Bessent, the current Secretary of the Treasury in the United States. As the nation braces for the upcoming fiscal year, projections indicate that his government could see net interest payments surpassing this monumental threshold. This projection not only reflects the growing fiscal challenges facing the country but also signifies a burgeoning crisis in America’s financial management. The interplay of a swelling deficit, currently at an alarming 7% of the nation’s Gross Domestic Product (GDP), paired with the steep rise in government bond yields experienced over the preceding four years, paints an increasingly grim picture for the U.S. budgetary framework.

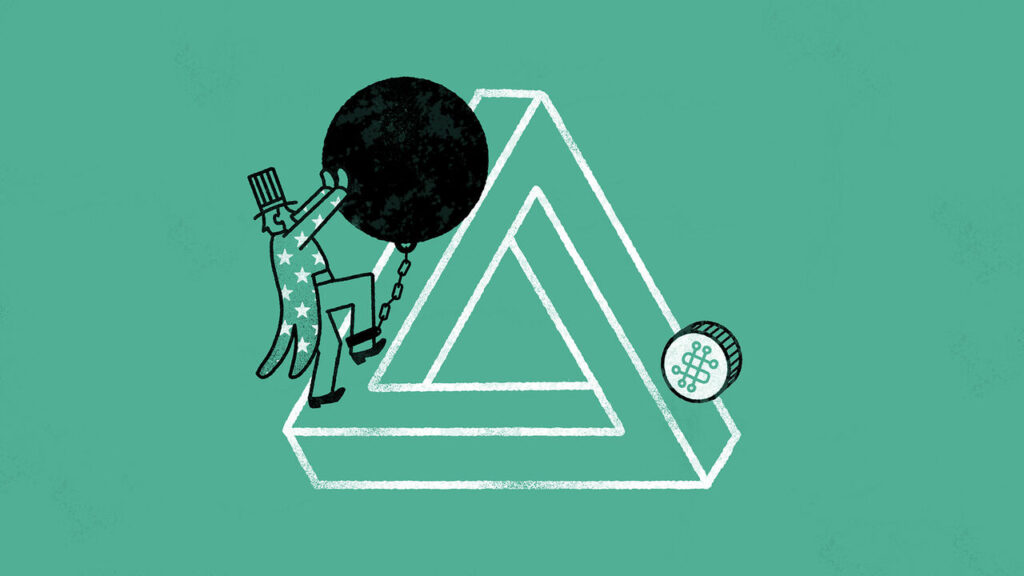

The sharp rise in interest rates has profound implications for federal finances. As bond yields climb, the cost of servicing the national debt escalates, thereby exerting additional pressure on fiscal resources. The impact of substantial interest payments cannot be understated; they consume a substantial portion of the federal budget, ultimately limiting the government’s ability to invest in crucial infrastructure, education, healthcare, and other vital services that require federal funding. This financial stranglehold further aggravates the existing deficit, creating a vicious cycle that seems difficult to break without strategic intervention.

Moreover, Republicans and Democrats alike are faced with the daunting challenge of addressing this fiscal imbalance. Political partisanship often complicates these discussions, with proposed solutions ranging from slashing expenditures to raising taxes or a combination of both. Each party’s approach typically reflects its ideological beliefs about governance and the role of government spending in the economy, leading to contentious debates in Congress. This lack of consensus not only hampers immediate remedies but also contributes to a growing distrust among the electorate, who are increasingly concerned about how these financial woes will impact their everyday lives.

Foreign investor sentiment also plays a crucial role in this equation. The United States has long been seen as a bastion of economic stability, with U.S. Treasury bonds regarded as a safe haven. However, as net interest payments balloon, there may be a shift in how foreign stakeholders view U.S. debt instruments. Increased yields can make U.S. bonds more attractive in the short term, but persistent fiscal mismanagement may lead some investors to reconsider their positions. Should confidence wane, the consequences could be dire, potentially leading to higher borrowing costs and a further squeeze on fiscal resources.

Simultaneously, there is a broader global dimension to consider. Many advanced economies are grappling with similar issues of debt and rising interest rates. The interconnectedness of the global economy means that shifts in American fiscal health can reverberate worldwide. Countries with significant holdings of U.S. debt may face pressure if the U.S. is perceived as having a weak fiscal foundation. Consequently, the need for a coherent strategy not only positions the United States favorably within the international arena but also ensures better stability for those economies intertwined with American financial practices.

In light of these pressing challenges, it becomes crucial for policymakers to craft a sustainable fiscal strategy that addresses both the immediacy of rising interest payments and the underlying issues contributing to the deficit. It necessitates a comprehensive examination of government spending priorities, potential reform of tax structures, and perhaps even a reevaluation of national programs that are major contributors to the deficit. The road ahead is undoubtedly fraught with challenges, but with strategic leadership, there is potential for a transformative approach that could stabilize the national financial landscape and restore public confidence in U.S. fiscal policy.

In conclusion, the looming trillion-dollar question poses significant hurdles and opportunities for Scott Bessent and his colleagues in the government as they attempt to navigate the complexities of a rapidly deteriorating fiscal environment. Building bipartisan support and fostering trust among the populace and investors alike will be paramount in addressing and eventually overcoming the considerable challenges that lie ahead.