The article titled “Artificial food colours are out, so what’s next?” addresses the significant changes occurring in the food industry regarding food coloring. With recent decisions by the U.S. Food and Drug Administration (FDA) to ban certain synthetic dyes, including Red Dye No. 3 and plans to phase out petroleum-based dyes like Yellow Dye 5 and 6, the industry faces a pressing need for natural alternatives. As of January 2025, the FDA aims for the elimination of artificial dyes to reduce children’s exposure to synthetic chemicals, a shift led by pressures from parents, consumer advocates, and a growing public focus on healthier eating.

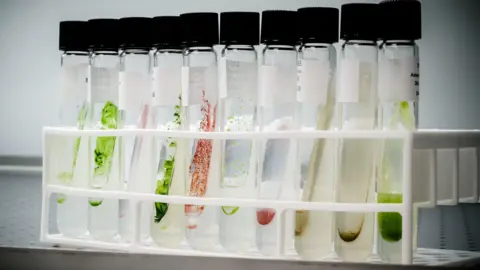

The article highlights the ongoing efforts by companies such as French firm Fermentalg, which is dedicated to harnessing the potential of microalgae for new food pigments. Their chief scientific officer, Hywel Griffiths, elaborates on the extensive exploration of microalgae species globally, identifying Galdieria sulphuraria as a promising source of a blue pigment, aptly named Galdieria blue. Fermentalg is confident in bringing products made with this natural pigment to the market in the near future, with FDA approval already secured for Galdieria blue, along with other natural extracts.

A more complex landscape emerges as the article points out, particularly with firms like Sensient, which process natural materials to extract vibrant colors needed in food products. Sensient’s CEO, Paul Manning, describes how their method involves harvesting crops rich in color content, such as carrots and potatoes, and transforming them into concentrated color extracts. This approach contrasts sharply against synthetic dyes, with which many brands traditionally relied. However, the transition to natural colorings poses challenges. These alternatives must match the vividness of synthetic colors to compete successfully in the marketplace.

The FDA’s recent decision, though not a formal ban, sets the stage for a voluntary transition by the food industry, driving companies to reformulate their products significantly. Notably, well-known brands, including WK Kellogg, Nestle, Kraft Heinz, and General Mills, are already committed to removing artificial colors from their offerings by 2026. This move reflects a broader trend among manufacturers to adapt to consumer preferences favoring transparency and natural ingredients in food products.

Despite the buzz surrounding these developments, the article highlights the potential difficulties ahead. Many natural dyes do not boast the same shelf stability or wide array of hues as their artificial counterparts. As food scientist Renee Leber from the Institute of Food Technologists notes, the urgency for brands to switch may lead to bottlenecks in production as companies scramble to secure enough natural color options to meet demand. Moreover, customers have demonstrated a willingness to critique products based on aesthetic appeal; shades that lack vibrancy may not resonate well with consumers.

As the food industry approaches this critical juncture, brands are encouraged to explore new sources of colorings that align with changing regulations and consumer expectations. Whether through innovative processes like those of Fermentalg or natural ingredient sourcing as performed by Sensient, the drive for safe and appealing food colors is leading to what could be a significant transformation in food manufacturing practices.

In conclusion, the shift away from artificial food colorings marks a notable paradigm shift in the food sector, indicating a commitment to health and consumer choice. While the challenges of matching synthetic vibrancy and stability remain, the ongoing evolution promises exciting new possibilities for naturally sourced colors that meet both regulatory requirements and consumer demands. As this transition unfolds over the next few years, the outcome of these adjustments could redefine branding and product strategy for several established players in the food industry, marking a significant milestone in the American culinary landscape.