Good evening, I’m reporting live on the recent rollercoaster ride that Nvidia’s stock has taken investors on. The $3 trillion tech darling has seen a meteoric rise of about 750% since the start of 2023. However, in a sudden turn of events, a wave of volatility has caused shares of Nvidia to briefly plummet. Despite bouncing back on Tuesday, this sudden dip has served as a reminder to investors that flying too close to the sun can have consequences.

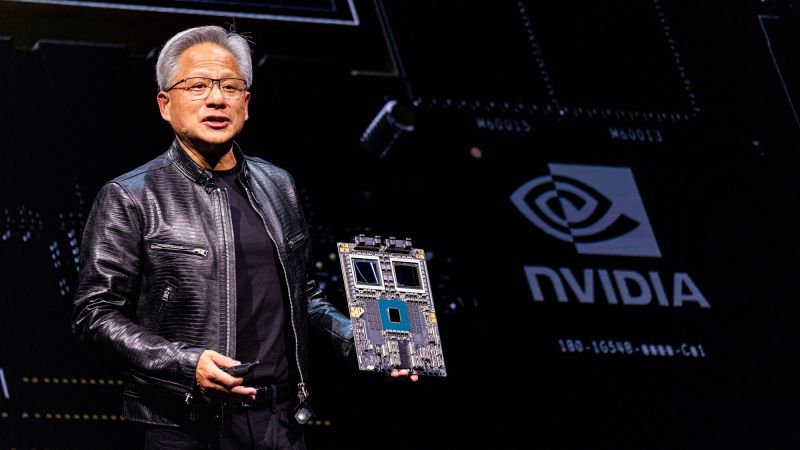

Nvidia’s recent journey has been nothing short of a whirlwind. In just 30 days from April 2024, the chipmaker added a trillion dollars to its market cap, reaching an astounding $3 trillion. To put this into perspective, it took Warren Buffett about 60 years to build Berkshire Hathaway into a nearly trillion dollar company. On June 18, Nvidia’s market value even surpassed Microsoft’s to become the world’s most valuable company.

This unprecedented growth has not gone unnoticed by the market. Nvidia alone is responsible for about 35% of the S&P 500’s total gains this year, making it one of the most influential companies on the index. The recent plunge in Nvidia’s stock, shedding $430 billion in value over three days, has rattled investors and raised questions about the sustainability of its growth.

Despite the recent volatility, Nvidia remains a hot topic among investors. While some analysts predict that the stock bubble will eventually burst, others like Neil Roarty from Stocklytics believe that Nvidia’s growth remains solid. The stock is up another 2.3% in premarket trading on Wednesday, signaling continued enthusiasm among investors.

In other news, Levi’s is facing scrutiny over its ethical standards after an independent labor monitoring group accused the company of ignoring its own labor standards. Critics allege that Levi’s continued working with a factory in Turkey that fired hundreds of workers for joining a union and going on strike. Turkey’s apparel industry is a critical part of the global supply chain, and Levi’s response to these allegations will be closely watched.

Furthermore, a system outage at CDK Global has left nearly 15,000 car dealerships across North America struggling to provide services to customers. Tom McParland, owner of Automatic Consulting, highlighted how this outage is impacting customers by limiting their choices and bargaining power when buying a car. The outage is expected to take several days to resolve, leaving customers and dealership employees in a state of uncertainty.