### Rolls-Royce Envisions AI-Powered Future as a Market Leader in the UK

In an intriguing statement from Rolls-Royce’s chief executive, Tufan Erginbilgic, the renowned engineering company posits that its ongoing investment in artificial intelligence (AI) powered by small modular nuclear reactors (SMRs) could establish it as the largest corporation in the United Kingdom. This assertion is backed by the company’s recent agreements to provide these innovative energy solutions to both the UK and Czech Republic governments, aimed specifically at fuelling AI-driven data centers.

The emergence of AI as a significant technological force since 2022 has raised concerns regarding its substantial energy consumption, triggering discussions around environmental sustainability and practicality. However, Erginbilgic remains optimistic, asserting the potential of Rolls-Royce’s initiatives to propel the company above its competitors, enabling it to surpass others listed on the London Stock Exchange in terms of valuation.

### A Unique Position in Nuclear Technology

Erginbilgic emphasizes Rolls-Royce’s unparalleled capabilities in the nuclear realm, indicating that no other private company possesses the same level of expertise. This sentiment reinforces the company’s ambition to dominate the global market. Under his leadership, Rolls-Royce has seen a remarkable ten-fold increase in its share price since his appointment in January 2023, which is a testament to the changes implemented under his direction. Notably, he has dismissed the idea of listing the company’s shares in New York—unlike other corporations such as Arm Holdings, Shell, and AstraZeneca—maintaining that success can be achieved without a transatlantic move.

Despite a substantial demographic of shareholders and clientele based in the United States, Erginbilgic asserts that Rolls-Royce’s vision does not hinge on American investments. He argues for a more localized approach to business growth, suggesting that the company has exhibited robust performance without needing to appeal solely to the U.S. market.

### Investment in Small Modular Reactors

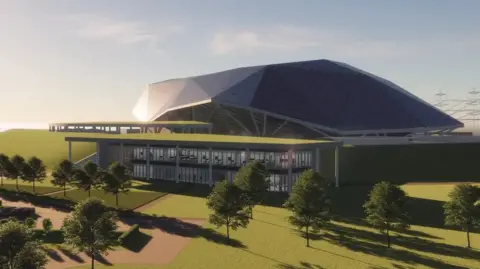

The discourse around SMRs reveals that these smaller reactors not only have a quicker construction timeline than traditional nuclear plants, but also offer the prospect of lower costs as they are mass-produced. Erginbilgic predicts that, by 2050, around 400 SMRs will be required globally, a significant market worth over a trillion dollars that he anticipates Rolls-Royce will lead.

However, this technology is still unproven, lacking currently functioning examples. Nevertheless, Erginbilgic expresses unwavering confidence in its future potential. Challenges regarding the environmental impact—particularly concerning water usage for cooling in data centers and SMRs—are being addressed through deals struck with major tech giants like Google and Microsoft, who are already planning to utilize SMR energy in the coming years.

### The Future of Aircraft Manufacturing

While Rolls-Royce seeks to advance its SMR projects, the company’s primary expertise remains in aircraft engines. With a dominant foothold in the market for wide-body aircraft engines, such as those used in the Boeing 787 and Airbus A350, Rolls-Royce is also strategizing to penetrate the lucrative market for next-generation narrow-body aircraft akin to the Boeing 737 and Airbus A320. This segment poses a significant opportunity valued at approximately $1.6 trillion, dwarfing the wide-body category.

Despite the challenges posed by entrenched competitors like CFM International—a collaboration of GE Aerospace and Safran Aerospace Engines—Erginbilgic argues that entering this market is not merely about profits; it represents a significant opportunity for the UK’s overall economic strategy and growth.

### Market Recovery and Future Prospects

The revival of Rolls-Royce’s fortunes correlates closely with Erginbilgic’s appointment, occurring at a time of renewed demand for aircraft engines following the COVID-19 pandemic. Moreover, the situation in Ukraine has led to increased defense spending across Europe, further bolstering one of the company’s critical business segments.

While critics have emerged regarding Erginbilgic’s aggressive management style—evident from significant job cuts early in his tenure—overall employment has increased since 2023. Some industry insiders express “grudging respect” for the transformative strategies he has implemented, attributing a portion of the company’s recovery to favorable market conditions and the efforts of his predecessor.

In contemplating whether Rolls-Royce can ascend to become the UK’s most valuable enterprise—challenging established players like AstraZeneca, HSBC, and Shell—Erginbilgic asserts the company’s present position and growth potential creates a viable path to achieving that goal. Rolls-Royce now occupies fifth place on the FTSE index, underscoring its revitalized status and market momentum. Ultimately, as the company sets sail toward this ambitious horizon, it appears poised to solidify its legacy of engineering excellence on a renewed foundation of innovation and growth.