In a recent critique by the UK’s Competition and Markets Authority (CMA), it has been revealed that profit margins for petrol and diesel are alarmingly high despite a noticeable decline in fuel prices at the pump. According to the CMA, who released the report just prior to the holiday season, drivers across the UK might still be overpaying for fuel due to these persistently elevated profit margins that do not appear to correlate with the operating costs of retailers.

The report comes at a critical juncture, especially as millions of drivers prepare for seasonal travel, raising concerns about pricing fairness in the fuel sector. The CMA has explicitly stated that while fuel prices have indeed decreased since its last analysis in 2023—largely attributed to falling oil prices—the profit margins for both supermarket and non-supermarket fuel retailers have remained historically high. With petrol at an average of 136.8 pence per liter and diesel at 146.1 pence, the watchdog has pointed out a significant disconnect between the prices consumers are paying and the operational costs retailers claim to be facing.

One of the notable components in this discussion is the CMA’s rebuttal of retailers’ claims that heightened operating costs justify the steep fuel margins. The CMA suggested that if these costs were genuinely rising as retailers state, we would naturally see a decrease in profit margins. Therefore, the conclusion drawn by the CMA is that increased competition could lead to better pricing strategies for consumers at the fuel pumps.

As part of the government’s ongoing efforts to combat this issue, a “fuel finder” scheme is set to be introduced. This innovative system aims to provide real-time comparisons of fuel prices, enabling drivers to make informed purchasing decisions while on the road. Reportedly, as part of this scheme, retailers will be required to report pricing changes within a 30-minute timeframe to ensure all consumers have access to the most current fuel prices. The CMA has expressed optimism that this transparency will facilitate more competition among retailers, ultimately leading to more competitive pricing.

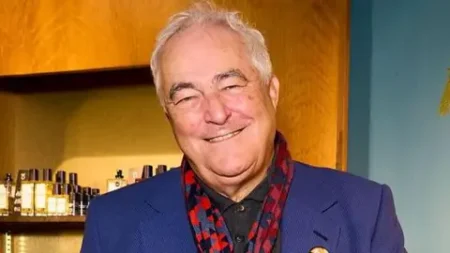

While the CMA’s report challenges the assertion by the Petrol Retailers Association (PRA) claiming that reduced fuel prices indicate healthy competition, the PRA counters that this doesn’t consider the significant changes in operational costs encountered by retailers. Gordon Balmer, the executive director of the PRA, elaborated that factors like increased labor costs, taxes, energy prices, and theft have considerably impacted retailers. Although retail prices have been declining from their peaks in 2022 and 2023, Balmer emphasizes that historic comparisons fail to adequately account for these economic pressures.

Furthermore, both the RAC (Royal Automobile Club) and the AA (Automobile Association) have echoed concerns regarding overpricing at fuel stations. The AA specifically highlighted that, despite a drop of more than 7p in wholesale petrol prices since November, the average price at the pump has only decreased marginally—indicating that consumers may not be benefiting adequately from wholesale reductions.

The CMA’s initiative to foster increased competition is particularly relevant, especially during this time of year when consumer travel peaks. The authority’s senior director, Dan Turnbull, emphasized the criticality of fair pricing for motorists as they plan their Christmas journeys. As the CMA gears up to enforce compliance with the upcoming fuel finder scheme, including penalties for non-compliance, it remains to be seen how these developments will play out in the competitive landscape of the UK fuel market.

In summary, the CMA’s scrutiny into fuel pricing, particularly the finding of persistently high profit margins despite declining pump prices, underscores the urgent need for transparency and competition in the fuel sector. With upcoming initiatives like the fuel finder scheme, authorities aim to empower consumers, incentivize retail competition, and ultimately ensure that drivers are no longer unfairly burdened at the pump.