In recent times, the convergence of interests between the White House, Wall Street, and Silicon Valley has elevated artificial intelligence (AI) to a paramount priority. This consensus underscores a collective acknowledgement that advancements in AI have significant implications for economic growth, national security, and technological supremacy. As a result, major tech companies are funneling vast resources into developing data centers and robust infrastructure aimed at harnessing the power of AI technologies. This monumental shift is evidenced by the White House’s strategic AI action plan, unveiled in July, which aims to solidify the United States’ leadership in this emergent field.

The tech industry’s enthusiasm for AI is also mirrored in financial markets, where investments in AI-related stocks—like Nvidia (NVDA)—are reaching unprecedented heights, as the company’s market performance continually breaks records. However, the backdrop of President Donald Trump’s trade policies, particularly the ongoing trade war, has prompted questions about the strategies of the current administration. Critics argue that certain tariffs introduced could inadvertently inflate the costs of essential materials and components vital for AI model development.

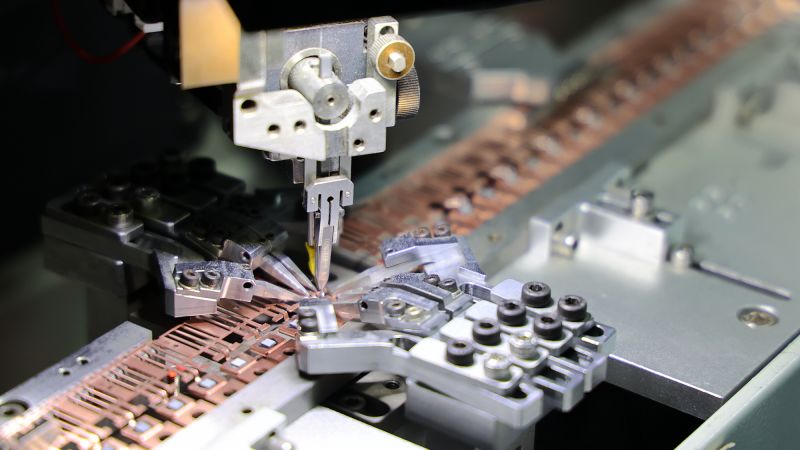

A notable example is Trump’s announcement on August 6 regarding a proposed 100% tariff on semiconductor imports, although he hinted at exemptions for companies dedicated to expanding manufacturing within the U.S. Tariffs imposed earlier on materials like copper, crucial for electronic components including circuit boards and chips, further complicate the business landscape. Nevertheless, experts contend that while tariffs may create cost-related uncertainty, technological innovation will not be hindered, as the competitive stakes in the global AI race remain exceedingly high.

For established tech giants such as Meta and Microsoft, the potential consequences of falling behind in AI could outweigh any burdens from tariffs. Dallas Dolen, PricewaterhouseCoopers’ lead on technology, media, and telecommunications, articulates this perspective by referring to the AI boom as an “existential moment” for the industry. He emphasizes that for companies of this magnitude, the imperative to innovate in AI overshadows incremental cost considerations when faced with existential threats.

Profoundly positive signals emerged from the earnings reports of major tech players like Meta, Microsoft, and Google, all of which indicated considerable investments in AI, with signs of growing returns. Meta’s substantial capital expenditures—amounting to $17 billion for the quarter ending in June—translate into a remarkable 38% increase in earnings per share since the previous year. The stock market reacted positively to these results, leading to a 9% surge in after-hours trading in response to the earnings announcement.

Microsoft followed suit, reporting robust outcomes largely fueled by its thriving cloud computing division, and announcing ambitious plans for further capital investments. Its stock has witnessed a similar ascent, showing a 26% increase over the year. Alphabet’s commitment to raise its capital expenditures to $85 billion by 2025 reflects the escalating demand for its cloud services, further solidifying its position amidst the generative AI boom.

As Goldman Sachs predicts, global power demands from data centers, essential for AI functionality, are projected to substantially escalate in the coming years. Comments from Wedbush Securities analyst Dan Ives highlight the nascent phase of the fourth industrial revolution, emphasizing the critical roles played by tech titans like Nvidia, Microsoft, and Alphabet. However, the rapidly evolving tariff landscape complicates the visibility of the actual effects such tariffs might impose on the costs associated with data centers.

Although some estimates suggest a potential increase in construction costs ranging between 5% and 7% due to tariffs, prevailing market forces and insatiable demand may necessitate that large companies absorb these additional financial burdens rather than risking their competitiveness in AI. Conversely, smaller firms, lacking comparable financial leverage, may struggle to navigate these challenges. With tight funding from private investors and the long-term commitment required for data center projects, the vulnerabilities of these smaller entities become more pronounced.

The daunting timelines involved in constructing data centers, which can range from one to three years, along with their expected lifespan of 25-30 years, amplify the risks associated with uncertain tariff policies. It remains ambiguous whether future semiconductor tariffs will exert upward pressure on construction costs, but Trump’s administration has voiced intent to exempt firms committed to expanding in the U.S. from such levies.

The collaborative environment between the White House and Silicon Valley is likely to pave avenues for easing the impact of tariffs. This includes a willingness from the government to negotiate terms that could benefit tech leaders. Building AI infrastructure is central to the White House’s action plan targeting streamlined processes for establishing data centers and semiconductor manufacturing facilities, an initiative that seeks to capitalize on the U.S.’s existing advantages in data center infrastructure.

Ultimately, the United States maintains the lead with the highest concentration of data centers globally, leveraged by major players like Microsoft and Amazon. Industry experts underline the strategic importance of this sector, as it underpins national advantages that must be preserved and enhanced in the face of global competition. As the stakes of AI continue to rise, the intersection of policy and technological innovation will be crucial in shaping the future landscape