In a notable exchange of political discourse, Kemi Badenoch, the Transport Secretary, and Sir Keir Starmer, the leader of the opposition, have engaged in a heated debate over a recent promise from the cabinet concerning tax hikes affecting individuals with what has been termed “modest” incomes. This confrontation took place during Prime Minister’s Questions (PMQs) and reflects the broader tensions surrounding economic management in the lead-up to the forthcoming autumn budget.

Transport Secretary Heidi Alexander initially stirred controversy with her claim made during a Sky News interview, where she stated that individuals earning “modest incomes” would be shielded from any forthcoming tax increases. This assertion, however, has led to significant confusion among ministers, leaving many to ponder exactly who qualifies as having a “modest” income. During the PMQs session, Badenoch questioned Starmer’s understanding and knowledge of this complex issue, suggesting that the leader of the Labour Party was lacking clarity.

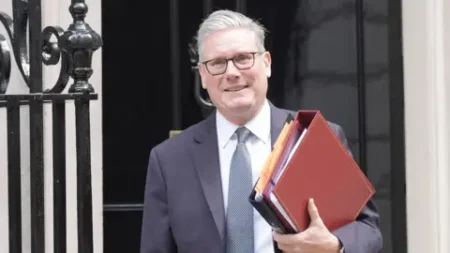

In response, Prime Minister delivered a defense of his government’s economic record. He directed criticism towards the Conservative Party’s fourteen-year track record, stating that it has resulted in “stagnant” economic growth. His remarks underscore the political battle over economic stewardship, with both parties striving to portray themselves as the champions of working-class individuals struggling to make ends meet.

The discussion on tax policies is particularly pertinent given Labour’s election manifesto pledge, which explicitly aimed to protect “working people” from tax increases. This promise was a focal point leading to the previous budget discussions, wherein officials found themselves grappling with defining who precisely fell under this “working people” umbrella. The intricacies became more pronounced with Alexander’s recent comments, which suggested that current discussions would aim to empower those identified as “people on modest incomes.”

Badenoch, during the first PMQs of the session, rebuked Starmer to clarify the confusion arising from the cabinet’s statements. She criticized the inability of ministers to effectively communicate who would benefit from these promised tax protections. The Prime Minister responded by elaborating on his government’s initiatives aimed at the very demographic often left vulnerable—in this case, hard-working individuals who lack substantial savings.

The government anticipates that the upcoming Budget will likely involve tax increases, prompted by dismal economic indicators and previous policy reversals regarding welfare cuts. Despite promises not to raise key revenue-generating taxes such as income tax rates, VAT, or corporation tax ahead of the next general election, there remains an air of uncertainty regarding how these fiscal decisions will unfold.

In a more complex development relevant to the tax narrative, some Labour backbenchers are advocating for additional taxes aimed at wealth accumulation, further complicating the political landscape. Badenoch accused the governing body of contemplating potential taxation on pension contributions, although her elaboration on this was brief and somewhat vague.

Historically, the definition of a “working person” for the purpose of tax pledges has deviated significantly based on political agendas. In previous encounters, the Prime Minister characterized “working people” as those who engage in manual labor and earn their living without relying on additional sources of income such as dividends or rental earnings. This broader definition was later softened, allowing for some contingencies regarding individuals with minimal savings or those holding stocks in tax-advantaged savings accounts.

As the pressure around fiscal policies mounts in anticipation of the autumn Budget, the communication strategies from both the government and the opposition remain exceptionally crucial. With so much at stake concerning cuts, taxes, and overall economic strategy, both parties must navigate the complexities of public sentiment while remaining resolute in their fiscal philosophies. The dynamics at play promise to evolve as we approach the Budget, with clear and concise communication becoming imperative to maintain voter confidence amidst rising economic challenges.