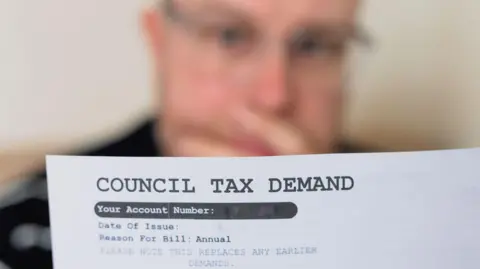

Struggling households across England are facing a staggering cumulative debt of approximately £6.6 billion in unpaid council tax. This figure has been compounded by an additional £642 million in arrears accumulated over the past year alone, raising serious concerns about the financial health of vulnerable families. When combined with data from Scotland and Wales, the total amount owed by households in these three regions has surpassed the £8 billion mark, highlighting a significant issue that requires immediate attention from both local authorities and the government.

As council tax bills are set to rise in the upcoming years, many campaigners are advocating for a shift in how local councils manage and collect these debts. They argue that the current approach often utilizes harsh measures, such as deploying bailiffs to retrieve unpaid amounts, which can exacerbate the financial difficulties faced by already struggling individuals and families. Their call for a more empathetic collection approach reflects an urgent need for systemic reform in how council tax arrears are handled, prioritizing support rather than punitive actions.

In response to the growing issue, the UK government has acknowledged the rising concern regarding unpaid bills. Chief Secretary to the Treasury Darren Jones confirmed that the Treasury has built into its financial plans an assumption of a consistent 5% increase in council tax rates annually. Local councils have the autonomy to raise their taxes to this cap, and they can go beyond it with the assistance of local referendums or explicit permission from the central government.

However, despite the increase in revenue from council tax collection— which saw local authorities in England collect a total of £41.2 billion over the past year, up £2.8 billion from the previous year—the total owed has also grown, rising by 11% during the same period. The statistics reveal a troubling trend where the amounts due escalates even as councils collect more money. Specifically, Scotland reported £1.5 billion in arrears, while Wales accounted for another £160 million.

Many charity organizations, such as Debt Justice, have raised concerns regarding the impact of these collection policies on individuals with low incomes. Their representatives indicate that vulnerable people who fall behind on payments often face severe consequences, such as councils demanding immediate payment of the outstanding balance or resorting to legal enforcement through bailiffs. Toby Murray from Debt Justice poignantly noted, “People in council tax arrears are overwhelmingly on low incomes, and many are living in poverty.” His remarks underscore the disproportionate burden placed on those already facing financial hardships.

In light of these challenges, the government has unveiled proposals aimed at reforming council tax collection practices. One such proposal seeks to cap the fees applied when debts are pursued through the courts. Additionally, they are contemplating adjustments to the timeline that determines when a household becomes liable for a full year’s council tax, allowing for a more flexible repayment structure. Ministers are currently reviewing the practices surrounding debt enforcement, including the conduct of bailiffs, reflecting a recognition of the need for greater accountability and compassion in the system.

To further ease the financial strain, the government is considering making 12 monthly payments the standard for council tax rather than the current 10-month system. These potential changes could pave the way for a more humane approach towards local tax debt, ensuring that struggling households receive the support they need while managing their financial obligations effectively.

In conclusion, with an alarming amount owed in unpaid council tax, coupled with impending billing increases, there is a collective call for reform in the way council tax debts are pursued. It is imperative for both local councils and the government to reevaluate their strategies for collecting such debts and to explore more sympathetic alternatives that account for the reality of living under financial duress.