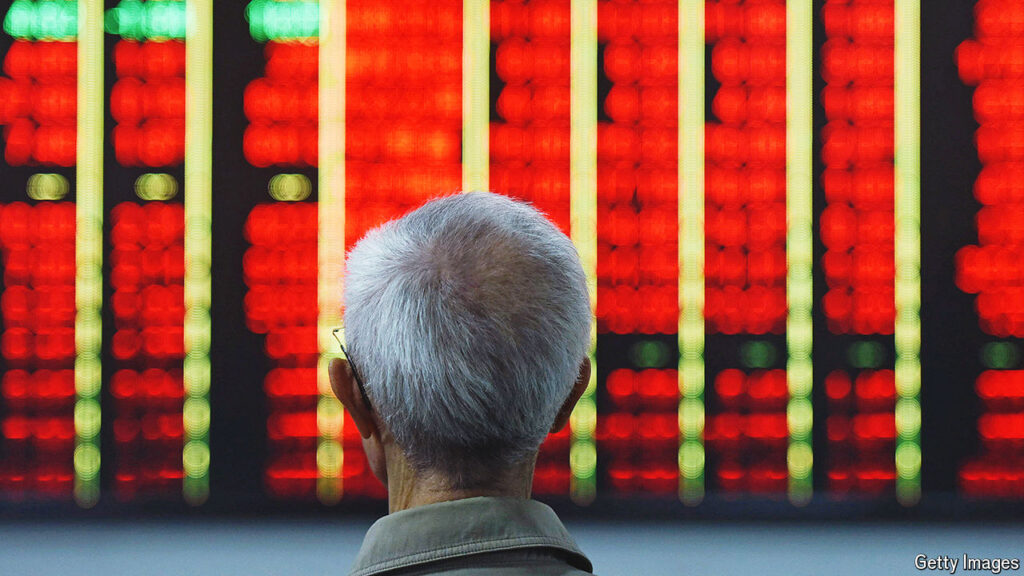

Investors in China’s stock market have seen significant gains this year, with the Shanghai composite index rising by 12% from a multi-year low in February. This rally, despite a recent drop, has been welcomed by equity analysts and state media alike. The surge in stock prices has been a relief for Xi Jinping, China’s leader, as retail investors own a significant portion of the market. The previous market rout had caused a great deal of distress among investors and raised concerns about the country’s economic future.

The recovery in the stock market has been largely attributed to good governance and a stroke of good luck. However, a significant portion of the rally can be attributed to the intervention of the “national team”, a group of state-owned institutions that step in to stabilize the market during times of volatility. While this intervention may have helped boost stock prices in the short term, it has also raised concerns about the long-term implications of state interference in the market.

One of the ways in which the state has attempted to boost share prices is by limiting the number of initial public offerings (IPOs). This move has restricted exit opportunities for private investors, ultimately giving state capital more control over the market. These interventions have created distortions in the market that could potentially stifle the growth of China’s most innovative firms. By favoring state-owned enterprises over private companies, the government risks hindering the development of a diverse and competitive market.

Despite the short-term gains seen in the stock market, there are concerns about the sustainability of this rally. The reliance on state intervention to prop up stock prices raises questions about the health of the market and the level of government control over economic activity. Investors may be enjoying the current gains, but there is a sense of unease about the implications of government interference in the market.

Looking ahead, it will be important for China to strike a balance between supporting market stability and fostering a competitive and innovative investment environment. The government’s heavy-handed approach to managing the stock market may have provided a short-term boost, but it also risks undermining the long-term health of the market. Investors will be watching closely to see how the government navigates the delicate balance between intervention and letting the market operate freely.

In conclusion, while investors in China’s stock market have seen gains this year, there are concerns about the sustainability of this rally. The heavy hand of government intervention in the market has raised questions about the long-term health of the market and the impact on private investors and innovative firms. Finding a balance between market stability and a competitive investment environment will be crucial for China as it navigates the challenges of managing a rapidly growing economy.