**House Stalemates as Trump’s Budget Bill Faces Opposition**

As the clock ticks towards Donald Trump’s imminent July 4th deadline, the president’s comprehensive tax and spending budget bill has returned to the House of Representatives, navigating a path fraught with challenges. The Senate, having initially passed the bill after an intense 24-hour debate culminating in a tie-breaking vote by Vice President JD Vance, has only set the stage for further complications in the House, where Speaker Mike Johnson grapples with internal dissent among Republican lawmakers.

Attempts to bring the legislation up for a vote have encountered significant hurdles. Members of the House were left disillusioned as the afternoon unfolded, quickly clearing the floor in the face of an evident lack of support needed to pass even the procedural rule to allow the bill to be voted on—an ordinarily straightforward measure. This current version, burdened with amendments that have raised the stakes higher than initially anticipated, has drawn critical attention following a narrowly passed previous incarnation just last May.

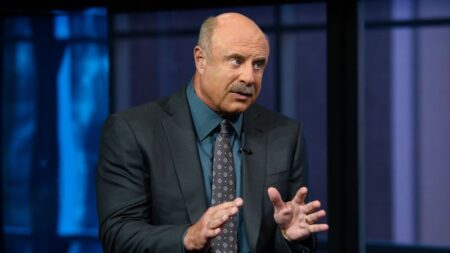

Despite the Republican majority in both chambers of Congress, ideological factions within the party are exposed, each vying for dominance over foundational policies encapsulated in the lengthy and intricate bill. Trump’s considerable involvement through meetings at the White House symbolizes his commitment to rally support; however, his efforts yield mixed results as some representatives remain unconvinced. Notably, House Republican Ralph Norman from South Carolina expressed doubts about the bill’s viability, identifying around 25 fellow Republicans echoing his concerns, while emphasizing the importance of addressing their reservations prior to any voting process.

The contentious nature of the legislation revolves around crucial issues, particularly its impact on the national deficit and cuts to essential social programs like healthcare. Historical patterns suggest that Republican lawmakers, despite early signs of rebellion, ultimately align with presidential directives. Although this dynamic could be tested, given the bill’s status as a pivotal component of Trump’s second-term legislative agenda.

**Key Areas of Concern and Fractured Party Lines**

A significant contention point arises from a Congressional Budget Office (CBO) report indicating the potential for the bill to increase the national deficit by approximately $3.3 trillion over the next decade, contrasting sharply with the $2.8 trillion projection of its earlier version. Such ramifications draw severe backlash from fiscal conservatives within the House Freedom Caucus who threaten to derail the legislation, expressing concerns echoing sentiments famously articulated by Elon Musk regarding national debt sustainability.

Representative Chip Roy from Texas, aligned with the House Freedom Caucus, further amplified these frustrations, underscoring the dilapidating prospects of meeting Trump’s July 4 deadline amid these growing tensions. As dissent deepens, the fiscal hawks remain adamant on their stance against deficits, fueling calls for substantial revisions.

Subsequent criticisms have emerged concerning provisions to healthcare programs like Medicaid, particularly from representatives serving lower-income districts concerned about the ramifications of cuts on their constituents. Congressman David Valadao from California articulated a clear commitment against endorsing any final bill that would jeopardize vital funding or exacerbate healthcare access for millions.

Additionally, as negotiations unfold, there are representatives like Randy Fine from Florida asserting a more conciliatory approach, suggesting that while he finds points of contention in the Senate bill, the necessity to maintain progress should guide their actions.

**Controversies Over Tax Deductions: The SALT Clause**

Another contentious debate centers around modifications pertaining to state and local tax (SALT) deductions within the budget bill, which temporarily are set to increase from a present cap of $10,000 to $40,000. However, the Senate’s version reinstates the lower cap after a five-year period, placing considerable pressure on House Republicans who advocate for more permanent relief.

The pathway ahead remains unpredictable as all options remain on the table, with Trump’s agenda resting heavily on reconciling the contentious elements that have stymied progress. Through the convergence of fiscal conservatism, healthcare concerns, and tax deduction dynamics, the upcoming days will be critical in determining the bill’s fate and the overall stability of Trump’s legislative ambitions leading into July.