Investment advice can often feel overwhelming, given the sheer volume of opinions and strategies available. However, distilling this guidance into succinct phrases can provide clarity and direction. One of the most straightforward yet impactful pieces of advice one might encounter is simply to “buy stocks.” This recommendation, while brief, resonates because historically, equities have outperformed many other asset classes over the long term. The potential for substantial gains serves to attract both novice and seasoned investors alike.

Building upon this notion, the advice to “buy American stocks” is even more specific and strategic. Over the past several decades, investing in American equities has consistently yielded high returns, thanks in part to the robust economic growth and innovation seen in sectors such as technology, consumer goods, and finance. Not only does this focused approach enable investors to capitalize on the strength of U.S. markets, but it also aligns with a global trend where many of the world’s most successful companies are based in America. Thus, the emphasis on American stocks offers a compelling case for those seeking a lucrative long-term investment strategy.

On the other hand, an equally notable piece of advice is to “not waste money on stockpickers’ fees.” Many investors fall into the trap of believing that they can significantly outperform the market by relying on professional stockpickers, who often charge hefty fees for their services. However, studies have shown that the majority of these professionals struggle to consistently beat benchmarks after fees are taken into account. As such, a more prudent approach may be to invest in low-cost index funds or exchange-traded funds (ETFs), which offer exposure to a broad market index without the premium costs associated with active management.

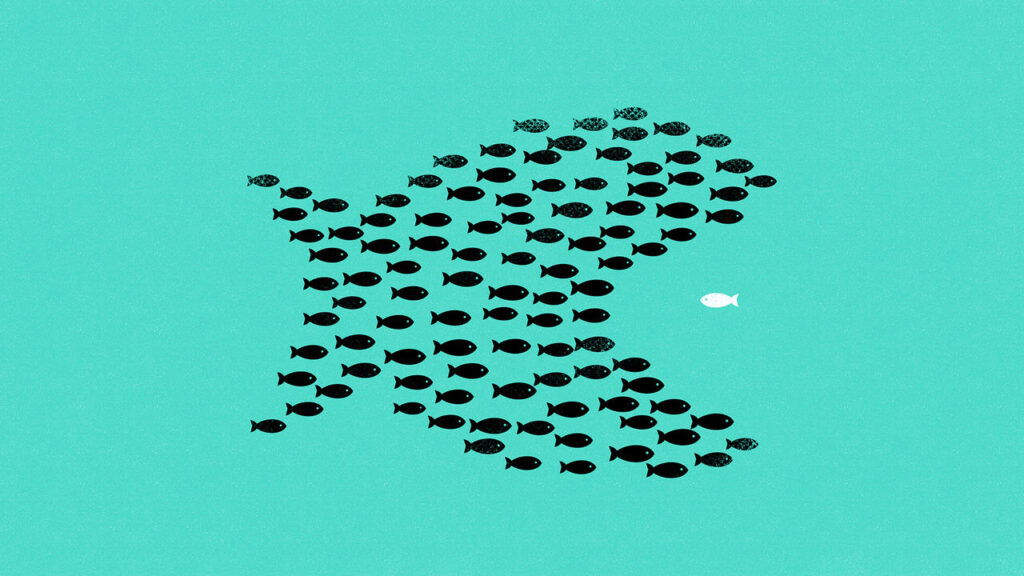

While short phrases can convey powerful messages, a more nuanced suggestion emerges with the idea that “a diversified portfolio can yield similar returns as a concentrated one, but with reduced risk.” This advice taps into the essential principle of diversification—spreading investments across various asset classes, sectors, and geographies to mitigate risk. In contrast to a concentrated strategy, where an investor might place a significant amount of money in a limited number of securities, a diversified approach allows individuals to weather market volatility more effectively.

For example, an investor who diversifies their portfolio among stocks, bonds, real estate, and commodities stands to gain from the positive performance of different asset classes, even when some may underperform. During economic downturns, while certain sectors may suffer, others could thrive, balancing out potential losses. This tactic greatly enhances risk management and can lead to more stable returns over time.

In conclusion, the world of investing is rich with various strategies and philosophies, each offering unique perspectives on how to achieve financial success. While simple advice like “buy stocks” and “buy American stocks” remains powerful due to their historical performance, it’s also crucial to consider the importance of cost-efficiency when investing and the benefits of diversification. A well-rounded investment approach that encompasses these principles can lead to a more secure financial future and an improved investment experience, ultimately allowing investors to navigate the complexities of the market with greater confidence. By combining brevity with strategic depth, individuals can grasp the fundamental elements of investing and apply them to their financial journeys.