**Nvidia Faces $5.5 Billion Hit Amid New US Export Restrictions on Chip Sales to China**

In a recent announcement, Nvidia, the prominent American microchip manufacturer, revealed that it anticipates incurring a substantial financial impact of approximately $5.5 billion (£4.2 billion). This decision comes in response to the United States government’s tightening of export regulations concerning semiconductor technology destined for China. Nvidia, which has emerged as a powerhouse in the artificial intelligence (AI) sector, will now require export licenses for one of its flagship products, the H20 AI chip, which has gained significant traction in the Chinese market.

The enforcement of these new export controls coincides with an intensification of the trade conflict between the US and China, characterized by steep tariffs imposed by both nations on a range of goods. This geopolitical landscape has further complicated the dynamics of international trade, particularly in the tech industry, where components like microchips are crucial to the functionality of advanced technologies, including AI systems and computing.

Following the announcement of these regulations, Nvidia experienced a notable decline in its stock value, with shares dropping almost 6% in after-hours trading. The company communicated to investors that the requirement for export permits was conveyed to them last week and explicitly includes sales to China as well as Hong Kong. Nvidia indicated that the US government has advised that this licensing mandate would remain in effect for an indefinite period, underscoring the long-term impact of these measures.

In its statement, Nvidia pointed out that the license requirement is aimed at mitigating the risk that its products might be utilized in, or redirected to, supercomputers within China. The company, however, refrained from providing additional commentary when approached by the BBC for further insights on the matter. The US government’s decision reflects a broader initiative to limit China’s access to advanced technologies that could bolster its supercomputing capabilities, which are often seen as dual-use technologies with potential military applications.

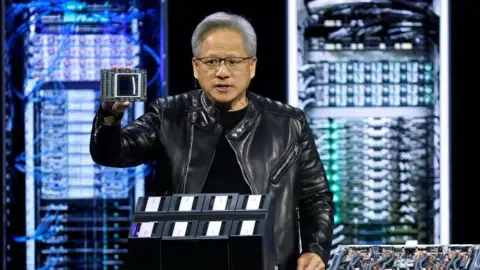

Founded in 1993, Nvidia first gained recognition for its graphics processing units (GPUs) that catered primarily to the gaming community. Over the years, it has successfully expanded its portfolio to include AI-oriented chips that support machine learning functionalities. As such, Nvidia stands at the forefront of the burgeoning AI industry, playing a critical role in how rapidly AI technologies are being integrated into various sectors.

Before the advent of the AI boom, Nvidia was already innovating in features that enhanced the capabilities of its chips for machine learning tasks. Today, its products are pivotal in the acceleration of AI technology across the business landscape, making Nvidia a crucial barometer for observing advancements in AI and its adoption in industries worldwide.

Earlier this year, Nvidia’s market valuation came under pressure following reports regarding a rival Chinese AI application, DeepSeek, which had been developed at a significantly lower cost than traditional chatbots. This revelation raised concerns within the US tech community about domestic players potentially lagging behind China in AI advancements.

The financial repercussions of this new export regulation could have far-reaching consequences for Nvidia, both in terms of its immediate revenue from H20 chip sales and the broader implications for its operations in the lucrative Chinese market. Nvidia’s planned charges resulting from the licensing requirements will not only cover provisions related to its inventory and purchase commitments but also include reserves earmarked for these changes.

In conclusion, as Nvidia adapts to the new regulatory environment, stakeholders will be closely monitoring the effects on the company’s bottom line and its strategic positioning in the competitive semiconductor landscape, particularly as the dynamics between the US and China continue to evolve. The road ahead will undoubtedly be challenging, as the company navigates the complexities of international trade laws in a rapidly changing technological environment.