The emergence of Nvidia as the world’s most valuable company amidst a historic trade war between the United States and China has brought significant attention to the complexities of international trade and technology. Nvidia’s journey has culminated in a remarkable partnership with the U.S. government, involving a financial concession intended to ensure commerce in the lucrative area of artificial intelligence (AI) chip sales. This agreement, reached between Nvidia and the Trump administration, mandates that a portion of the revenues generated from the sale of high-end AI chips in China be paid to the U.S. Treasury, exemplifying unprecedented cooperation in a realm that could have far-reaching implications for global technology leadership.

In a bid to balance conflicting objectives—protecting America’s dominance in AI technology while negotiating a crucial trade agreement with China—the deal secures 15% of revenues from Nvidia and AMD’s semiconductor sales to China, facilitating the re-establishment of their export licenses. The Trump administration had previously obstructed the sale of certain AI chips such as Nvidia’s H20 and AMD’s MI308. The revival of sales was made viable through this recent arrangement, allowing both firms to recommence supplying their advanced technologies to the Chinese market.

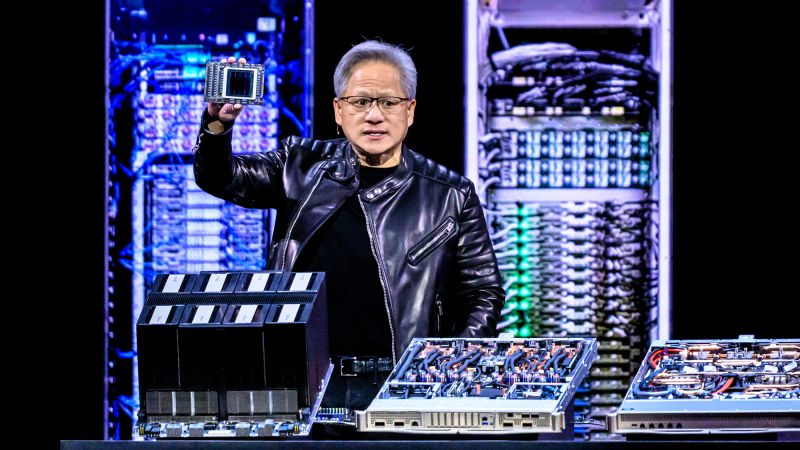

The landscape changed significantly when Nvidia’s CEO, Jensen Huang, engaged in discussions with President Trump, which set the stage for the restoration of export licenses. Initially, the administration proposed that Nvidia contribute 20% of revenues, but through negotiation, this was reduced to 15%. Although the deal appears beneficial to Nvidia, allowing them to resume shipments and recover lost revenue, there are concerns about the implications of such a voluntary payment structure, particularly regarding its legality and alignment with the U.S. Constitution, which prohibits export taxes.

Furthermore, experts have weighed in on the potential security ramifications of this partnership. Some question the rationale behind the payments and how they interact with national security concerns regarding technology exports to China. Critics argue that if there is a genuine risk associated with these exports, the financial arrangements would not effectively mitigate those risks. Ultimately, if there isn’t a substantial threat, some believe that the U.S. government should step back entirely from the regulatory framework.

As the situation unfolds, the administration’s approach seems to oscillate between a hawkish stance against China’s technological ambitions and a more pragmatic view that may reflect a recognition of China’s advancements in AI technology, which proceed regardless of U.S. efforts. In this context, Nvidia’s Huang has asserted that restricting American AI chip sales could be detrimental to U.S. national security, as it might enable Chinese developers to create competitive alternatives.

The response from China has also been noteworthy. Recent statements have surfaced suggesting skepticism towards the security of American-made chips, such as allegations of potential “backdoors” in these technologies. While Nvidia has consistently denied these claims, such rhetoric could hinder future sales and impact relationships with Chinese entities looking to innovate in semiconductors.

Looking ahead, the trade-offs and implications of Nvidia’s agreement with the U.S. government remain complex. As the administration seeks to leverage the arrangement as a bargaining chip in broader trade negotiations with China, questions linger regarding how this will impact both the U.S. technological advantage and the dynamics of international relations. Despite expectations of resumed shipments of Nvidia’s H20 chips to China, it’s unclear how responsive the Chinese market will be, especially in light of any potential security concerns raised by Chinese authorities.

Overall, this evolving scenario highlights the intersection of politics, technology, and economics. The U.S. amidst concerns over national security is navigating an intricate balance, recognizing the need to harness innovation while simultaneously managing relationships with a competitor that exhibits increasing technological prowess. As commitments to cooperate on AI technology take shape, the implications for future advancements and trade flows can only be contemplated. The outcomes of these decisions may shape not just corporate fortunes, but the broader landscape of global technology and its regulatory environment.