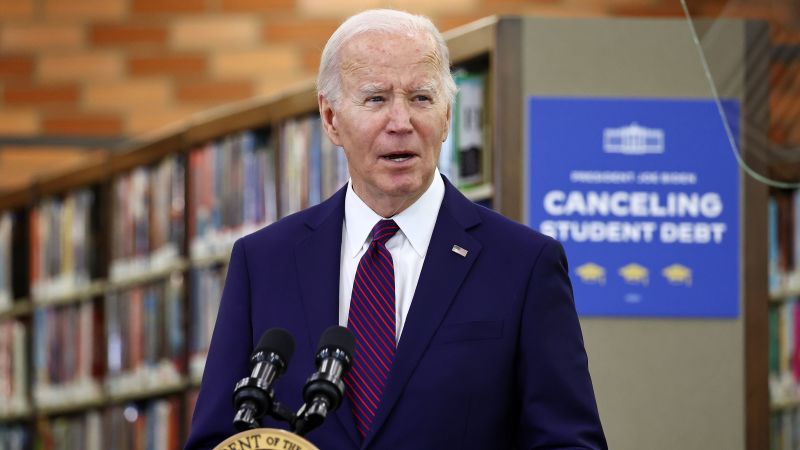

In a recent development, three Republican-led states have taken the initiative to request the Supreme Court to intervene and block an effort by the Biden administration to lower monthly payments for millions of student loan borrowers.

The program in question, known as Saving on a Valuable Education (SAVE), was established last year to reduce enrolled borrowers’ monthly payments and expedite the process of debt forgiveness. This initiative was launched in response to the Supreme Court’s decision last year to strike down a broader student loan forgiveness program.

South Carolina, Alaska, and Texas have filed an emergency appeal following a federal appeals court in Denver allowing the implementation of the program. This appeal once again brings the issue of student loan relief, a pivotal promise made by President Biden during his 2020 campaign, before the conservative-leaning Supreme Court.

“Due to the administration’s intransigence, the court must unfortunately step in again,” argued the states in their filing, urging the Supreme Court to review the legality of the program.

The Supreme Court is expected to establish a briefing schedule and may decide on whether to block the SAVE program within a few weeks. Nearly 8 million individuals are enrolled in SAVE, with approximately 3 million of them anticipating lower payments as of July 1 when the program was fully rolled out.

After initial resistance and legal challenges, the Department of Education announced that the 3 million borrowers expected to benefit from lower payments would be put in forbearance while the matter was being litigated. However, following the appeals court’s ruling in favor of the Biden administration, the Department of Education can now proceed with implementing the reductions.

The Department of Education disclosed last week that borrowers not already in forbearance would see their payments reduced by up to 50% in July, while those in forbearance would experience the payment reduction starting in August.

Under the SAVE plan, monthly student loan payments are determined based on the borrower’s income and family size, rather than the amount of debt owed. Approximately 4 million enrolled borrowers have a monthly payment of $0.

Despite multiple challenges from Republican-led states, including two earlier lawsuits, the program is now under scrutiny by the Supreme Court after a district court initially blocked its implementation, only to be overturned by the 10th US Circuit Court of Appeals. The Department of Education is yet to respond to inquiries regarding the emergency appeal made on Tuesday.