**Roomba Vacuum Cleaner Firm Files for Bankruptcy**

In a significant development in the tech industry, iRobot, the American company known for its innovative Roomba smart vacuum cleaner, has filed for bankruptcy protection as of December 15, 2025. This strategic move is largely attributed to intense competition from Chinese rivals and the financial repercussions of tariffs on goods imported from overseas.

The bankruptcy process chosen by iRobot is a pre-packaged Chapter 11, a legal restructuring option that allows the company to reorganize its debts while continuing its operations. Under this new arrangement, Shenzhen-based Picea Robotics, a primary manufacturer of iRobot’s products, will take over ownership of the company. This acquisition is expected to streamline operations and potentially revive the brand’s market position.

Examining the underlying factors, the fiercely competitive landscape has compelled iRobot to drastically cut its prices and heavily invest in new technologies. Recent filings reveal that U.S. import duties have cost the firm approximately $23 million in the current fiscal year alone. Most of iRobot’s devices manufactured in Vietnam for the American market are subject to a staggering 46% tariff, further exacerbating their financial challenges.

At its peak valuation, iRobot was worth approximately $3.56 billion in 2021, spurred by a surge in demand during the pandemic—an era that significantly boosted sales of its robotic cleaning devices. However, this inflated figure has plummeted dramatically, with the company’s current valuation hovering around $140 million, marking a stark decline. The company’s stock suffered an over 13% loss on the Nasdaq trading platform the previous Friday, indicative of the mounting concerns surrounding its business viability.

Despite the bankruptcy filing, officials from iRobot insist that the company’s app, supply chains, and customer support services will remain unaffected. This assurance aims to mitigate customers’ concerns regarding continued product functionality and service quality during the transition period.

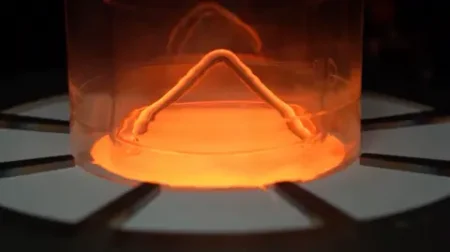

Founded in 1990 by a trio of engineers from the Massachusetts Institute of Technology’s (MIT) renowned Artificial Intelligence Lab, iRobot initially established its reputation in the defense and space sectors before conquering the consumer robotics market with the launch of the Roomba in 2002. Presently, the Roomba dominates the robotic vacuum sector, claiming approximately 42% of the U.S. market and a remarkable 65% in Japan.

A recent setback came in the form of a thwarted acquisition deal with Amazon, valued at $1.7 billion, which was ultimately blocked by the European Union’s competition watchdog. This incident reflects broader concerns about market consolidation and its impacts on competition in the technology space.

Former President Donald Trump’s administration’s trade mechanisms, specifically the tariffs imposed on foreign goods, have posed additional hurdles for many companies, including iRobot. While the rationale behind these import taxes was to fortify American jobs and industries, businesses reliant on international suppliers find themselves grappling with significantly increased operational costs.

Picea Robotics, the new parent company, is a manufacturer widely recognized in the robotic vacuum sector, featuring R&D and production facilities in China and Vietnam. With a workforce exceeding 7,000 employees globally, Picea has sold over 20 million robotic vacuum cleaners, establishing itself as a formidable player in an increasingly crowded market.

In summary, iRobot’s bankruptcy underscores the challenges many tech companies face in adapting to rapid changes in market dynamics, trade policies, and global competition. As Picea Robotics steps in to lead the transition, the future path for iRobot will rely heavily on its innovations and ability to navigate a complicated commercial landscape reshaped by evolving consumer preferences and competitive pressures.