The booming financial landscape of the UK has ignited fierce discussions surrounding taxation, particularly in light of the newly proposed fiscal policies aimed at stimulating economic growth and job creation. A comprehensive look at the media coverage highlights the sharp contrasts in interpretation and reception of these developments.

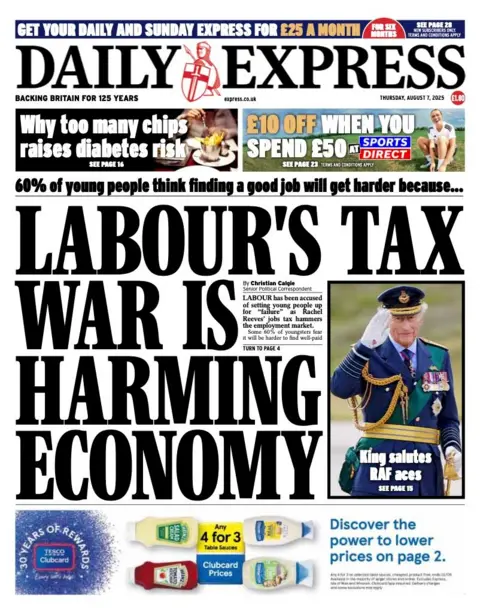

The Daily Express claims a “Labour’s tax war is harming the economy,” emphasizing public fears about employment prospects. Citing a study, it notes that 69% of young people believe that securing “a good job” will become increasingly difficult as Labour Chancellor Rachel Reeves’ policies take shape. This pessimistic view reflects concerns that taxation changes could stifle job growth and harm economic stability.

Similarly, the Daily Telegraph’s headline, “Starmer’s pledge on tax thrown into chaos,” aligns with this apprehensive narrative. This paper reveals that a £51 billion fiscal gap has challenged Labour’s tax promises, raising doubts about the continuation of a pledge not to increase income tax, National Insurance, or VAT. Prime Minister Sir Keir Starmer’s silence on these commitments has spurred speculation about the party’s ability to deliver on its promises.

In stark contrast, The Times focuses on a broader issue, titled “Wealthier areas face big rises in council tax.” The report indicates that high-income regions could see significant council tax increases should Labour’s strategy of diverting funds to impoverished areas proceed. By interacting with experts, the piece underscores the interconnectedness of local government funding and the potential repercussions of Labour’s policies.

The Metro dives into a different but urgent concern regarding the British NHS, framing its narrative with the headline, “I’m a doctor, get me out of here!” This alarming report highlights dissatisfaction among physicians, with 19% considering abandoning the profession within the UK. The driving factors behind such considerations include the better treatment they receive abroad, further complicating Labour’s healthcare funding approach.

The Financial Times offers a corporate perspective with a headline stating, “Company directors’ exodus gathering pace after non-dom tax breaks halted.” This report highlights a tangible shift; 3,790 directors reportedly left the UK following the elimination of favorable tax arrangements for non-domiciled residents. This exodus reflects broader economic anxieties and questions the ability of UK tax policy to retain high-caliber talent and investments.

Moreover, the i Paper alleges that Rushanara Ali, the Minister for Homelessness and Rough Sleeping, has acted controversially by evicting tenants to increase rental income. Such actions have raised ethical questions about the accountability of lawmakers and their alignment with the issues they ostensibly seek to address. Critics posit that the ministry’s approach to housing crises must align with more profound integrity and support.

Discussion surrounding UK tax policies has also reverberated within the public sector, as pointed out by the Daily Mail, which reports on controversial sessions held by HM Revenue and Customs staff discussing “the guilt of being British.” This internal seminar has come under fire from political leaders, including Tory leader Kemi Badenoch, who has described it as “nonsense” and suggested that civil servants disloyal to their nation should resign.

The Mirror and the Sun pivot the conversation back toward entertainment and culture with their focus on the BBC’s edits to the popular MasterChef series, framing it as “Cosmetic cowboys crackdown” and making headlines by playing on the notion of humor becoming “off the menu” due to politically correct censorship.

The diverse media coverage illustrates a complex landscape, where economic, healthcare, and ethical matters interweave with public perceptions and governmental accountability. Whether the proposed Labour policies will have the desired effect of fostering growth without escalating public dissent remains to be seen. As debates unfold, the scrutiny on tax policies grows, highlighting the need for transparency, consistency, and public trust in governance.