In a striking escalation of tensions, U.S. President Donald Trump has enacted an extraordinary 145% tariff on all imports from China, a bold move that contrasts sharply with his recent decision to suspend reciprocal levies against other nations. This action signals a significant intensification of the ongoing trade conflict, which many commentators are labeling a full-blown trade war. Chinese authorities have responded firmly, declaring their intention to “fight to the end” if Trump continues to escalate the situation. This resilience has manifested in increased tariffs imposed on American imports from China, further complicating the trade dynamic between the two superpowers.

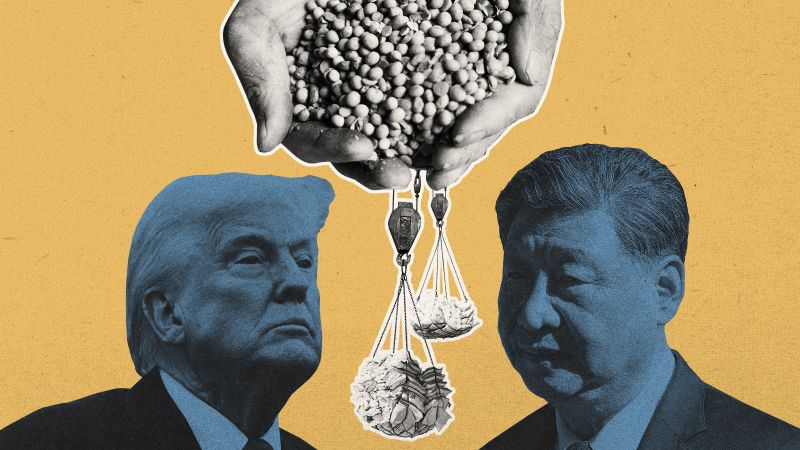

To understand the possible ramifications of this escalating conflict, CNN has conducted an analysis focusing on one of China’s largest imports from the U.S.—soybeans. These insights examine how alternative sources may meet this demand, the potential repercussions for U.S. farmers, and the broader implications for the agricultural sector as both nations grapple with increasing restrictions on trade. The intertwining economic relationship between the U.S. and China complicates the situation, as China exports approximately three times the amount it imports from the U.S., leading to a substantial trade surplus estimated at nearly $300 billion in China’s favor. This imbalance is a central reason why Trump is pushing for tariffs as a means to rectify what he views as an unfair trading practice.

The agricultural sector, particularly soybean producers, has found itself in a precarious position. China primarily imports agricultural products from the U.S., including soybeans, oilseeds, and grains. However, previous trade disputes during Trump’s first term already put significant pressure on these exports. As a result of a renewed tariff on U.S. products—now totaling 135% following the recent 125% tariff on soybeans—American farmers face the prospect of losing a critical market for their goods. During the last round of trade disputes, many U.S. farmers turned to alternative domestic markets, but the overarching concern remains: how will the U.S. agricultural sector manage this new wave of tariffs?

The past trade tensions have had tangible effects. During the previous trade war, Brazil emerged as a dominant player as China diverted its soybean imports away from the United States to mitigate the impact of tariffs. Since 2010, Brazilian soybean exports to China have more than doubled, whereas exports from the U.S. have stagnated. Last November, Chinese President Xi Jinping’s state visit to Brazil was explicitly focused on strengthening ties between the two countries, showcasing Brazil’s position as a significant competitor for China’s agricultural market and illustrating how geopolitical dynamics shift in response to trade relations.

Looking forward, Brazilian soybean production is expected to reach record levels, potentially allowing China to further increase its imports from Brazil as well as from Argentina, which ranks as the third-largest soybean producer globally. The American agricultural sector, particularly soybean farmers, have already faced cumulative losses of about $27 billion during the 2018 trade war, a staggering figure that highlights the severity of the challenges they face. A significant portion of these losses—around 71%—stemmed from diminished soybean exports.

Moreover, many of the farmers who inhabit key soybean-producing states, which predominantly supported Trump in the 2024 election, are still struggling with the repercussions of the previous trade disputes. The landscape of U.S. politics adds another layer of complexity, as agricultural policies and trade relations are often closely intertwined with electoral outcomes and voter sentiment.

In an attempt to broaden its economic partnerships to counteract U.S. tariffs, China is seeking alliances beyond Brazil. Recent statements from Chinese officials indicate a willingness to bolster trade ties with the Association of Southeast Asian Nations, while discussions with European Union officials involve negotiations on trade relief and issues concerning electric vehicles. As this situation continues to unfold, the trade strategies employed by both nations may significantly reshape the future landscape of international trade and diplomatic relations.