The Trump administration has exhibited a remarkable sense of indifference regarding the recent downturn in the stock market. On March 16th, in a statement that encapsulated the administration’s approach, Scott Bessent, who serves as America’s Secretary of the Treasury, remarked, “I can tell you that corrections are healthy, they are normal.” This comment came during a period when the stock market was experiencing a notable decline. Specifically, the S&P 500 index was down by 8% from its all-time high recorded in February, raising concerns among investors and analysts alike.

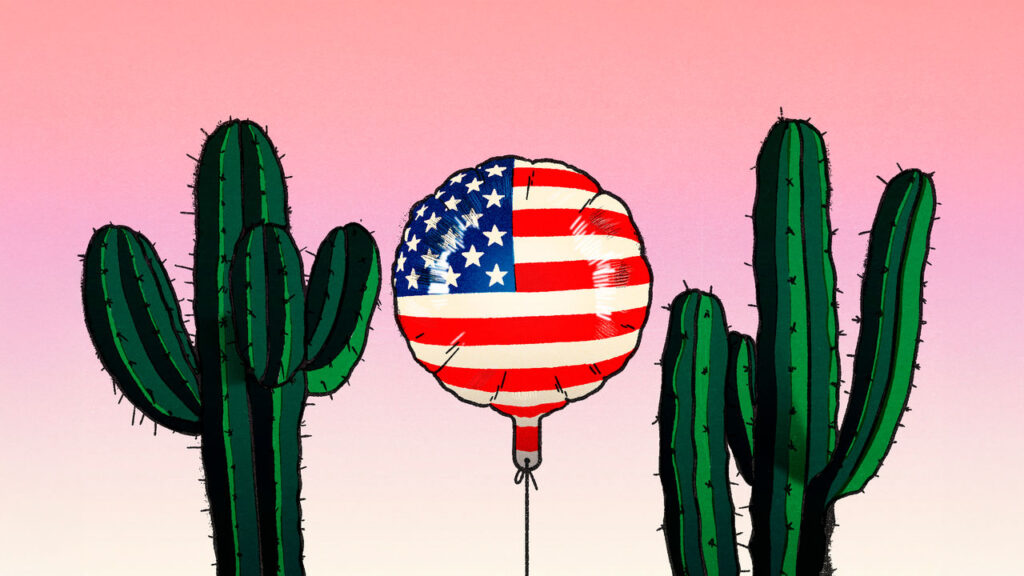

The context of the stock market’s decline is essential for understanding the broader implications. The drop has been attributed in part to President Donald Trump’s fervent enthusiasm for implementing tariffs as a part of his economic strategy. These tariffs, aimed at protecting American industries, have prompted fears of trade wars that could disrupt global supply chains and lead to retaliatory actions from other countries. The initial enthusiasm for growth and the promise of tax reforms under the Trump administration seemed to have reached a plateau, revealing vulnerabilities in market confidence.

In addition to the tariffs, the overall perception of the Trump administration’s lax attitude toward the market dip has raised eyebrows. Many investors believe that the administration’s casual response suggests a lack of urgency or concern for the potential negative consequences that stagnant or declining markets can carry. Instead of adopting a proactive stance to mitigate fears and restore confidence, the administration’s comments have given the impression of complacency. Critics argue that such an attitude might embolden the continuation of policies that could further harm market stability and investor sentiment.

Investor confidence is critical in shaping market trends. The psychology behind investment decisions can be heavily influenced by leadership communication. When high-ranking administration officials downplay significant market corrections, it can send mixed signals to the investors who closely monitor economic indicators for safety and growth. As a consequence, the combination of Trump’s tariff strategies and a perceived lack of a robust administrative response to market fluctuations may create an atmosphere of uncertainty.

Moreover, this focus on tariffs could be likened to a double-edged sword. While they are designed to protect American jobs and industries, they might provoke adverse reactions from international trade partners, leading to potential tariff escalations. This dynamic could provoke a vicious cycle of retaliatory measures, putting more strain on the American economy. The fear of prolonged trade disputes could stifle domestic investment and hamper long-term economic growth, directly impacting stock prices and investor behavior.

To compound the situation, the broader global economic landscape also plays a role. Other economies are closely watching the U.S. approach, and their responses to the tariffs and trade policies factored in. The interconnectedness of global markets means that instability in the U.S. could lead to ripple effects abroad. If other nations react negatively or adapt their policies as a counteraction to U.S. tariffs, the potential consequences could further dampen U.S. stock performance, leading to a downward spiral that affects not just the stock market, but also employment, production, and consumer spending.

In conclusion, the Trump administration’s relaxed stance regarding falling stock prices reflects a significant divergence from previous economic management approaches that often emphasize rapid responsiveness to market signals. Scott Bessent’s assertion of “healthy corrections” highlights a philosophy that could benefit from deeper engagement with market realities. As tariffs become a central focal point for this administration, it remains crucial to balance the protection of domestic interests with the imperatives of maintaining investor confidence and fostering a stable economic environment. Investors are not only concerned about current policy directions; they are also monitoring the potential ramifications of continued tariffs and the administration’s broader economic strategy on the horizon.