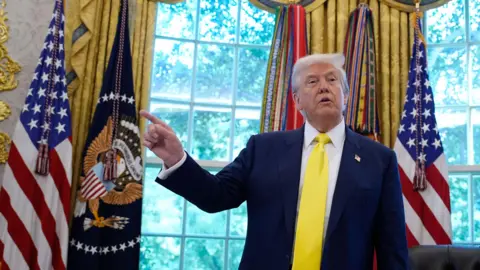

In a significant development on August 7, 2025, US President Donald Trump announced his initiative to enable American workers to invest their retirement savings in alternative assets such as cryptocurrencies, private equity, real estate, and precious metals like gold. In a compelling move aimed at decentralizing investment opportunities, Trump has mandated regulators to explore potential alterations to rules that have historically inhibited employers from including these forms of investment within workplace retirement schemes, prominently known in the United States as 401(k) plans.

This progressive measure seeks to democratize access to diverse investment channels that have traditionally been available only to affluent individuals and large institutional investors. With this directive, Trump aims to release untapped financial reservoirs into sectors that could benefit from increased participation by average Americans. The intention encapsulates the idea of empowering everyday savers to leverage their financial futures with the same strategies typically reserved for wealthier classes.

However, this initiative has generated concern among financial experts and critics who caution that such a shift could heighten risks for investors. The inclination to extend the types of investments available in retirement plans might expose individual savers to volatility and uncertainty inherent in the cryptocurrency market and alternative investment assets.

Currently, the landscape of retirement benefits in the United States is largely dominated by defined contribution plans, such as 401(k)s, due to the decline of traditional pension systems which guarantee payouts upon retirement. In these plans, participants can allocate portions of their earnings into investment accounts, which often come with employer match contributions. Historically, the firms facilitating these accounts have faced regulatory expectations to assess various factors, including investment risks and fees.

Notably, there has been reluctance among employers to offer investments like private equity within these retirement options. This hesitation is largely due to the higher fees associated with such investments, coupled with their lower liquidity and limited disclosure requirements, contrasting sharply with publicly traded companies. The recent executive order, however, tasks the Department of Labor with a 180-day timeline to evaluate existing regulations governing retirement accounts, although experts indicate that tangible changes may not occur in the immediate term.

Already, leading investment management firms such as State Street and Vanguard are paving the way for private-equity-oriented retirement fund offerings by forming strategic alliances with alternative asset managers like Apollo Global and Blackstone. These movements reflect an eagerness to explore new investment paradigms as a potential response to Trump’s latest directive.

Interestingly, Trump’s connection to the investment sector stretches to companies affiliated with cryptocurrency and investment accounts, indicating a vested interest in promoting his agenda. Notably, earlier in May 2025, the Department of Labor rescinded prior warnings that had advised retirement account providers to exercise caution before including cryptocurrencies, potentially signaling a regulatory embrace of decentralized finance options.

During Trump’s first term, similar initiatives had been undertaken, where the Department of Labor encouraged investment plans to consider private equity fund investments. However, the uptake was diminished due to concerns regarding the potential for litigation, and these guidelines were later repealed by the Biden administration.

In summary, Donald Trump’s latest push to allow alternative investments in retirement accounts signals a dramatic shift in the regulatory landscape of U.S. financial planning. While it aims to empower individual investors by expanding their financial horizons, it simultaneously raises important questions about risk and the reliability of such assets for retirement savings. As the Department of Labor embarks on this review, the ramifications of these potential policy changes remain to be fully assessed in both economic and personal investment contexts.