The recent passage of Donald Trump’s significant tax and spending legislation by the U.S. Congress marks a notable triumph for the president and his policies. On Thursday, after a tense series of debates in the House of Representatives, the bill was approved by a narrow vote of 218 to 214, succeeding in the Senate just days earlier by a similarly slim margin. This legislative victory is not only a critical step for Trump’s domestic agenda but also crucial for the Republican Party as they approach the upcoming elections.

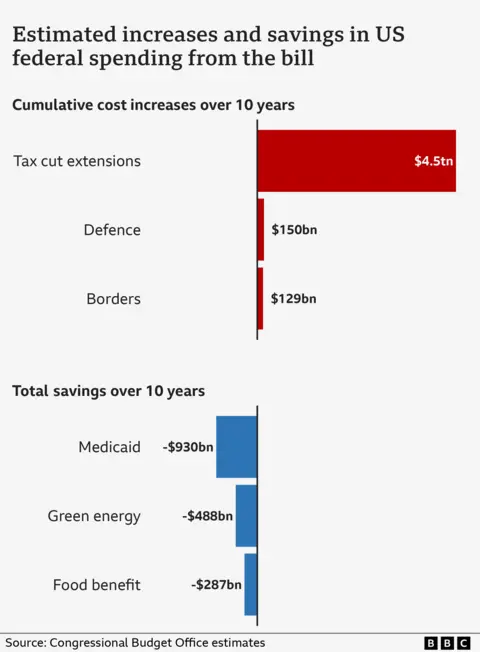

Trump had set a deadline for Congress to finalize the bill by July 4, underscoring the importance of this legislation to his administration. The Congressional Budget Office has estimated that the financial implications of the bill could result in an additional $3.3 trillion being added to federal deficits over the next decade, a forecast the White House has contested, asserting that such impacts are overstated. Critics, particularly from the Democratic Party, have expressed concern that the legislation could leave millions without necessary health coverage.

The president made exuberant comments regarding the bill’s passage, declaring it would “turn this country into a rocket ship,” highlighting his optimism about its potential to boost economic growth. He signaled his intent to sign the bill into law during a celebration on the national holiday, July 4th, a moment framed by Republican leaders as a pivotal point for Trump’s administration. Speaker of the House, Mike Johnson, championed the bill’s passage, crediting the group of Republicans who rallied support. His remarks reflected a theme of unity and determination within the party, emphasizing the necessity of belief in their political efforts.

Key figures, such as Representative Chip Roy from Texas, exhibited shifting perspectives on the bill. Initially opposed, Roy’s transformation into a supporting voice exemplifies the internal dynamics of party politics and the pressure lawmakers feel to align with party leadership. Moreover, the final vote showcased a surprising level of agreement within the GOP, with only a handful of dissenting votes emerging from Republican ranks.

Notably, the journey to passing this legislation was far from smooth. Opposition from Democratic leaders, particularly House Minority Leader Hakeem Jeffries, prolonged discussions with unprecedented speeches—one lasting nearly nine hours—aimed at highlighting potential negative repercussions of the bill on vulnerable populations. This delay served to underscore the stark division between the two parties, marked by different visions for social and fiscal policies.

From a content perspective, the legislation encompasses significant savings and spending allocations. It proposes cuts to food benefits and healthcare services while also curtailing tax breaks for clean energy initiatives. These changes are reflective of two central promises made by Trump during his campaign: making his earlier tax cuts permanent and reforming aspects of social security and benefit distributions.

Democratic representatives have rallied against the bill, describing it as harmful to many Americans while disproportionately benefiting wealthy individuals. Their criticisms include claims that the bill undermines essential services while enhancing tax benefits for the affluent. As vocal dissenters, members like Nancy Pelosi and Deborah Ross painted a bleak picture of the legislation’s implications for the broader American populace.

In conclusion, the approval of Trump’s expansive tax and spending bill illustrates the complexities of legislative governance in a polarized political landscape. As details emerge and more discussions unfold in the lead-up to the president’s signing ceremony, the implications of this legislation will continue to reverberate throughout the political arena. The ongoing debate reflects deeper structural divides within the fabric of U.S. society, encapsulating both the hopes and fears that accompany such transformative policies.