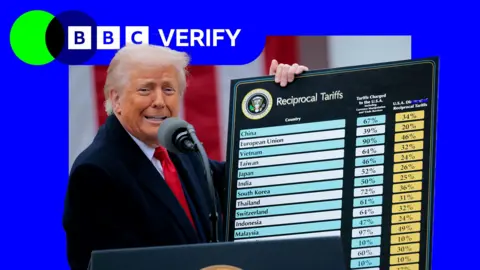

Donald Trump’s return to the presidency has had a profound impact on the global trading system, particularly in the United States. Following his announcement on April 2nd, dubbed “Liberation Day,” Trump implemented a series of extensive tariffs, significantly impacting the import landscape. These “reciprocal” tariffs targeted numerous countries, and while many tariffs have subsequently been paused, negotiations have led to agreements with partners including the United Kingdom, Vietnam, Japan, and the European Union to lower some of their tariff levels. However, specific industries, such as automobiles and steel, are still facing substantial tariffs, marking the overall average US tariff rate at its highest level in nearly a century.

The imposition of these tariffs represents a considerable shift in the way US companies engage with foreign goods. It’s important to note that the tariffs are ultimately paid by the American businesses importing goods, creating a ripple effect throughout the economy. As businesses adjust, the ramifications of these tariffs are beginning to manifest in both the domestic and global economies.

One of the immediate effects of Trump’s tariffs has been a marked increase in tariff revenues for the US government. According to analysis from the Budget Lab at Yale University, the effective tariff rate on imported goods skyrocketed from a mere 2.4% in 2024 to an astounding 18.2% by late July 2025. This substantial increase has led to a dramatic uptick in revenue from tariffs, with June 2025 seeing $28 billion collected—three times the revenue from the entire previous year. The Congressional Budget Office (CBO), an independent fiscal watchdog, estimated that this surge in tariff revenue could decrease projected US government borrowing by $2.5 trillion over the next decade. However, it’s essential to understand that while revenue is increasing, the CBO also cautioned that these tariffs may constrain economic growth compared to a scenario in which they were not imposed.

Contrary to what Trump’s administration may have aimed for, the tariffs have contributed to a widening of the US trade deficit. Trump has long viewed bilateral trade deficits as a sign that other countries are taking advantage of the US economy. While these tariffs were intended to address that imbalance by restricting imports, initial data reveals that US goods imports have, in fact, surged. US businesses stockpiled supplies prior to the implementation of tariffs to sidestep additional costs, leading to a short-term influx in imports, while exports only experienced modest gains.

Notably, the US goods trade deficit reached a high of $162 billion in March 2025, before retracting to $86 billion by June. This indicates that while short-term stockpiling may have inflated import levels, structural economic factors inherent to the US economy may continue to drive the trade deficit, suggesting a long-term challenge for the current administration.

Another notable impact of Trump’s tariffs has been seen in US-China trade relations, where punitive tariffs on Chinese imports have reduced the value of Chinese exports to the US by 11% in 2025 compared to the previous year. In contrast, China has shifted some of its export activities toward other trading partners, like India and regions within the EU, reflecting a strategic response to the new landscape created by Trump’s policies.

Furthermore, the economic reverberations are expected to extend to consumer prices. Economists are predicting that consumer prices in the US will rise as tariffs inflate the cost of imports. Recent data suggests a slight uptick in the inflation rate, illustrating the economic strain on US consumers. Major goods categories like appliances, computers, and sports equipment have started showing noticeable price increases, as retailers absorb the impact of tariffs.

Overall, Trump’s tariffs foreground complex issues in international trade, such as balancing tariff revenue generation with economic growth and managing the consequent inflation. The restructuring of trade relationships and the potential rise in US consumer prices present challenges that the Trump administration will need to navigate carefully as it continues to adjust its trade policies in an increasingly complex global trade environment.