In a significant development for higher education in the UK, tuition fees for undergraduate courses in England and Wales have officially increased to £9,535 per year. This rise marks the first adjustment in tuition fees since 2017, reflecting universities’ growing financial needs amid rising costs and inflationary pressures. In addition to the increase in tuition fees, government-provided maintenance loans have also seen an uptick, enabling students to access more financial aid to assist with their living expenses while pursuing their degrees.

The hike in tuition fees translates to an annual increase of £285, which is approximately a 3% rise. Consequently, undergraduate students now have the opportunity to borrow beyond previous limits to cover daily living costs, which is particularly crucial as many face an increasingly strained financial landscape. For example, the maximum maintenance loan available for students from England living away from home outside London has risen to £10,544 from £10,227. The Department for Education (DfE) announced these changes in November 2024, positioning them as necessary adjustments in light of inflation and the changing educational financing landscape.

As universities in England grapple with financial pressures, the Office for Students, the regulatory body overseeing educational institutions, reported alarming predictions that over 40% of universities might enter a financial deficit by the summer of 2025. This outcome is exacerbated by the recent spike in inflation, rendering tuition fees less valuable in real terms and a notable decline in the number of international students enrolled—an essential demographic that helps stabilize university finances. As a result, students have been advised that potential cuts to staff and course offerings could be on the horizon if these financial issues are not addressed adequately.

While the rising tuition fees impact students in England and Wales, tuition costs differ in other parts of the UK. In Northern Ireland, the maximum annual fee stands at £4,855 for local students, whereas non-local UK students pay £9,535. Scotland provides free tuition for many of its local students, charging £9,535 for others from the rest of the UK.

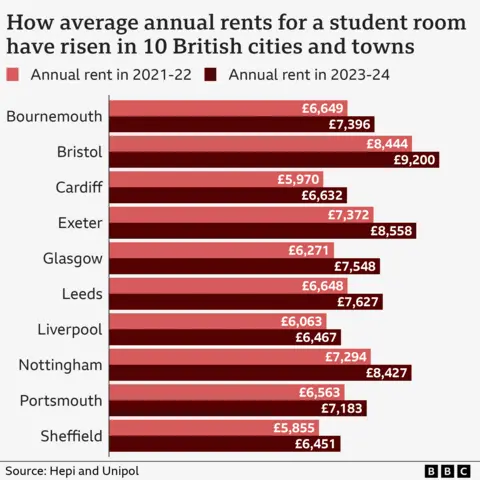

The situation for student accommodation has also worsened, complicating the financial burden on students. Recent research from the Higher Education Policy Institute (Hepi) indicates that average rents in university towns and cities have risen sharply, with costs escalating from £6,520 in 2021-22 to £7,475 in 2023-24 for ten selected towns, excluding London and Edinburgh. Some cities, such as Nottingham and Bristol, report even higher average annual rental costs, at £8,427 and £9,200, respectively. In London, purpose-built student accommodation averages a staggering £13,595 in yearly rent. This surge in accommodation costs often leaves students in precarious positions, with maintenance loans barely covering rent, significantly hindering their ability to meet other essential living expenses.

As students navigate their financial responsibilities, many find that part-time work has become increasingly essential to maintaining their livelihood while attending university. A recent student survey indicated that 68% of full-time undergraduates engaged in paid employment during term time, an increase from 45% the previous year. This trend underscores the growing challenges students face in reconciling educational pursuits with financial viability.

For those contemplating the long-term benefits of their investments in education, graduates tend to earn higher salaries compared to non-graduates, according to data from the Higher Education Statistics Agency (HESA). However, the gap in earnings between different fields of study and individual universities can vary considerably. Graduates from selective institutions like those within the Russell Group tend to have better outcomes, while reports suggest that women who pursued degrees in areas like creative arts may not experience a financial advantage compared to non-graduates. In contrast, those in fields such as law and medicine have a considerably more favorable earning trajectory throughout their careers.

In conclusion, the rise in tuition fees and the increasing financial burdens on students signal a challenging landscape for higher education. As funding pressures mount and the cost of living continues to rise, students must navigate a complex blend of tuition costs, living expenses, and the implications for their future earnings to make informed choices about their educational journeys.