The recent announcement regarding the U.S. government’s decision to take a 15% cut from chip sales made by prominent tech companies such as Nvidia and AMD to China has sparked significant interest and concern among industry watchers and policy makers alike. This unprecedented arrangement has raised questions about its implications for the global tech landscape and reflects a complex interplay of economic interests, national security considerations, and geopolitical dynamics.

The new measure comes on the heels of a tumultuous period in U.S.-China trade relations, particularly affecting the semiconductor industry. Earlier this year, the Trump administration moved to ban the sale of advanced chips to China, citing national security concerns as a primary reason. However, by mid-July, it appeared that the government had pivoted on this stance, lifting the ban and allowing companies to explore opportunities in the lucrative Chinese market. Yet, the recent decision to exact a cut from these sales introduces a novel layer to the relationship between the U.S. government and American businesses operating in China, prompting mixed responses from various stakeholders.

Industry analysts have characterized this deal as an unusual quid pro quo, suggesting that it reflects a worrying trend where the U.S. government is directly interfacing with corporate dealings for revenue generation. The implications of this move extend beyond mere economics; they signal a potential shift in how the U.S. government may handle its relationship with tech enterprises, especially those looking to do business in China. As Nvidia and AMD gear up to pay a percentage of their sales revenue back to the government, questions arise about how such policies may affect their profitability and operational strategies moving forward.

The significance of these chips cannot be understated; they are at the forefront of developments in artificial intelligence (AI), a field that is rapidly gaining traction and attracting substantial investment. Nvidia, recognized as a leading chip manufacturer, recently achieved a market valuation of $4 trillion, a notable milestone in the tech industry. The H20 chip developed by Nvidia, along with AMD’s MI308 chip, is tailored specifically for the Chinese market. These products offer a less powerful yet economically viable alternative for Chinese firms hungry for AI technology, enabling them to compete on a global scale.

Yet, this deal is not without controversy. Trade experts have described it as “unprecedented,” with many expressing concern over the potential ramifications for other American companies. Firms like Apple and Tesla, which hold significant stakes in China, now face uncertainty about what repercussions they might encounter if they engage in sales transactions there. The agreement has been met with skepticism regarding its clarity and the lack of transparency regarding the usage of revenue collected by the government.

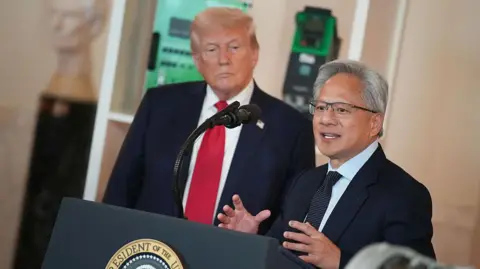

While the Biden administration’s lifting of the sales ban ostensibly caters to economic interests, lingering national security concerns are also at play. Experts warn that exporting AI chips to China could inadvertently bolster China’s technological capabilities, granting it an edge in both civilian and military applications. The rationale behind allowing these specific sales, juxtaposed with the previous ban, remains muddled and unclear in the current geopolitical landscape. Of particular interest is the role of lobbying—Nvidia CEO Jensen Huang’s influence seems to have been pivotal in securing favorable conditions for his company, reflecting the intricate relationship between corporate lobbying and government policy.

In conclusion, the agreement between the U.S. government and chip manufacturers such as Nvidia and AMD brings forth both opportunities and challenges. While it represents a monumental moment for the semiconductor industry, the potential for $2 billion in government revenue also raises questions about future U.S.-China relations, the evolving landscape of tech industries, and the implications for corporate governance. As the world watches how these dynamics unfold, it becomes evident that the intersection of national security, economic policy, and corporate interests is more intricate than ever. The coming months will likely reveal how this policy shift will resonate across various sectors and redefine America’s stance on trade with China.